1. Pax Americana measures its Mexican peso translation exposure (A-beginner). The U.S.-based multinational Pax Americana Inc. is...

Question:

1. Pax Americana measures its Mexican peso translation exposure (A-beginner).

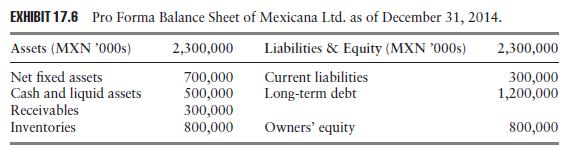

The U.S.-based multinational Pax Americana Inc. is concerned by the impact of the anticipated Mexican peso devaluation upon its net consolidated earnings, as well as on the net worth of its Mexican affiliate, Mexicana Ltd., whose pro forma balance sheet for December 31, 2014, is listed in Exhibit 17.6. On January 1, 2014, the prevailing spot Mexican peso (MXN) price of one US$ is MXN 12.5 = US$1.

a. Measure the translation exposure in peso terms that will be outstanding by December 31, 2014, using the currentoncurrent, monetaryonmonetary, and all-current methods.

b. What would be the translation loss or gain incurred by Pax Americana if the exchange rate at time of consolidation had depreciated to MXN 15 = US$1?

Show how this gain/loss would be reported under each method.

Step by Step Answer: