9. Hippocrates hedges its translation exposures (A-advanced). Hippocrates Inc. is a leading U.S.-based manufacturer of medical imaging

Question:

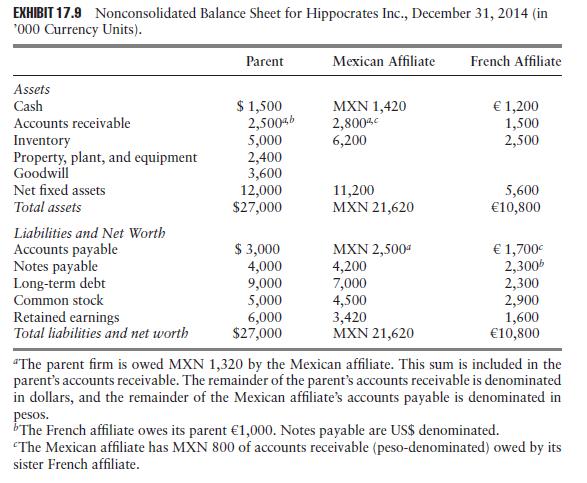

9. Hippocrates hedges its translation exposures (A-advanced). Hippocrates Inc.

is a leading U.S.-based manufacturer of medical imaging systems such as MRI machines with headquarters offices and manufacturing facilities in St. Paul, Minnesota. Its Mexican manufacturing and assembling affiliate, domiciled in

Mexico City, services the entire Latin American market. The French affiliate is domiciled in Paris and services the entire euro-zone area. The two affiliates’

balance sheets are prepared in Mexican pesos (MXN) and euros (€), respectively (see Exhibit 17.9). Current exchange rates are MXN 12.5 = US$1 = €0.80.

a. What is Hippocrates’ translation exposure to the Mexican peso and the euro, taking into account intracorporate transactions?

b. Would denominating in US$ all intracorporate transactions between sister affiliates or between affiliates and their parent materially affect Hippocrates’

translation exposures? How?

Step by Step Answer: