Mr. Arnett purchased 1,000 shares of Sure-Fire Limited, a public corporation, at $50 per share in 2011.

Question:

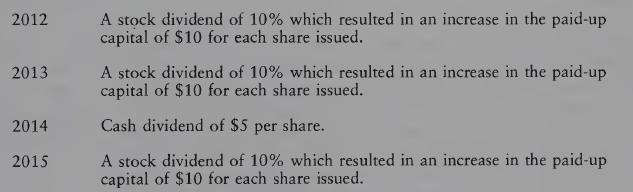

Mr. Arnett purchased 1,000 shares of Sure-Fire Limited, a public corporation, at $50 per share in 2011. Mr. Arnett received the following dividends subsequent to that time:

REQUIRED

Compute the taxable capital gain or allowable capital loss if Mr. Arnett sold 100 of the above shares in 2016 for $45 per share less brokerage fees of $100.

Transcribed Image Text:

2012 2013 2014 2015 A stock dividend of 10% which resulted in an increase in the paid-up capital of $10 for each share issued. A stock dividend of 10% which resulted in an increase in the paid-up capital of $10 for each share issued. Cash dividend of $5 per share. A stock dividend of 10% which resulted in an increase in the paid-up capital of $10 for each share issued.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 50% (4 reviews)

NOTE TO SOLUTION 2016 P of D ...View the full answer

Answered By

Somshukla Chakraborty

I have a teaching experience of more than 4 years by now in diverse subjects like History,Geography,Political Science,Sociology,Business Enterprise,Economics,Environmental Management etc.I teach students from classes 9-12 and undergraduate students.I boards I handle are IB,IGCSE, state boards,ICSE, CBSE.I am passionate about teaching.Full satisfaction of the students is my main goal.

I have completed my graduation and master's in history from Jadavpur University Kolkata,India in 2012 and I have completed my B.Ed from the same University in 2013. I have taught in a reputed school of Kolkata (subjects-History,Geography,Civics,Political Science) from 2014-2016.I worked as a guest lecturer of history in a college of Kolkata for 2 years teaching students of 1st ,2nd and 3rd year. I taught Ancient and Modern Indian history there.I have taught in another school in Mohali,Punjab teaching students from classes 9-12.Presently I am working as an online tutor with concept tutors,Bangalore,India(Carve Niche Pvt.Ltd.) for the last 1year and also have been appointed as an online history tutor by Course Hero(California,U.S) and Vidyalai.com(Chennai,India).

4.00+

2+ Reviews

10+ Question Solved

Related Book For

Introduction To Federal Income Taxation In Canada 2016-2017

ISBN: 9781554968725

37th Edition

Authors: Robert E. Beam, Stanley N. Laiken, James J. Barnett

Question Posted:

Students also viewed these Business questions

-

The following additional information is available for the Dr. Ivan and Irene Incisor family from Chapters 1-5. Ivan's grandfather died and left a portfolio of municipal bonds. In 2012, they pay Ivan...

-

Ms. Plant decided to purchase shares in Schvantz Ltd., a public company. She purchased 800 shares at $25 per share plus brokerage of $690 on May 24, 1998. The following additional transactions took...

-

The following additional information is available for the Dr. Ivan and Irene Incisor family from Chapters 1-6. On December 12, Irene purchased the building where her store is located. She paid...

-

Suppose n is divisible by 6. Let (,P) be the space = {1,...,n} with the uniform probability P, let A be the event consisting of all even numbers, and let B be the event of all numbers divisible by...

-

Taylor Corporation has hired a marketing representative to sell the companys two products: Marvelous and Wonderful. The representatives total salary and fringe benefits are $8,000 monthly. The...

-

How should a direct reporting engagement be carried out?

-

Visit The Cool Hunter (www.thecoolhunter.net) and identify examples that would provide marketers insights regarding social trends.

-

Webb Corporation prepares financial statements in accordance with IFRS. Selected accounts included in the property, plant, and equipment section of the company's statement of financial position at...

-

Your answer is partially correct. Try again. Pletcher Dental Clinic is a medium-sized dental service specializing in family dental care. The clinic is currently preparing the master budget for the...

-

Mr. Sung bought 1,000 shares of Norwood Ltd. at $10 per share on October 1, 2015. On December 15, 2015, Mr. Sung sold 1,000 shares at $5. On January 3, 2016, he bought 1,000 shares at $6. On November...

-

Consider the following transactions in the shares of Dachshund Airways Ltd: REQUIRED Compute the taxable capital gains, if any, on the 2009 and the 2016 sales. Date April 2004 March 2006 Aug. 2009...

-

A window with a 20-foot perimeter (frame) is to be comprised of a semicircular stained glass pane above a rectangular clear pane, as shown in the accompanying figure. Clear glass costs $3 per square...

-

Finding Confidence Intervals. In Exercises 9-16, assume that each sample is a simple random sample obtained from a population with a normal distribution. Professor Evaluation Scores Listed below are...

-

Pacifico Company, a U . S . - based importer of beer and wine, purchased 1 , 7 0 0 cases of Oktoberfest - style beer from a German supplier for 4 5 9 , 0 0 0 euros. Relevant U . S . dollar exchange...

-

7.C. a. When you add two vectors you get another vector: yes or no? b. When you subtract two vectors you get another vector: yes or no? c. Given the coordinate system below where increasing numbers...

-

Problem 1 At a given instant, the position of a plane at A and a train at B are measured relative to a radar antenna at O. Determine the distance d between A and B at this instant. To solve the...

-

The Bell-Boeing V-22 Osprey tiltrotor is both an airplane and a helicopter. It's advantage is the ability to rotate its engines and rotors to vertical position for take-off, landings, and helicopter...

-

Write an article on "Proteins"

-

Comptech Ltd is a manufacturer of optical equipment. In September 2019, Ed Thompson the Chief Research Officer, attended a conference in Switzerland that focused on optical developments for the 21st...

-

The following selected tax information has been taken from the books and records of your client, Mr. Weilman. Non-capital loss arising in 2008 $33,000 Net capital loss arising in 2009 25,000 Listed...

-

Mrs. Plant, age 47, is married and has three children: Amanda, age 24, Joan, age 17, and Courtney, age 16. Her own income for tax purposes of $60,000 includes employment income of $52,000. Amanda has...

-

Angelina and Romeo are the divorced parents of Maria, who is 10 years old. Angelina and Romeo have joint custody and Maria lives every second month with the other. Both Angelina and Romeo have...

-

Physical Units Method, Relative Sales Value Method Farleigh Petroleum, Inc., is a small company that acquires high - grade crude oil from low - volume production wells owned by individuals and small...

-

A proposed $2.5 M investment in new equipment at a 100 MG/y M&Ms factory will save the plant $800,000/y in energy costs. Assuming an annual interest rate of 5%/y (compounded annually), and an...

-

Brief Exercise 10-7 Coronado Company obtained land by issuing 2,250 shares of its $14 par value common stock. The land was recently appraised at $103,240. The common stock is actively traded at $44...

Study smarter with the SolutionInn App