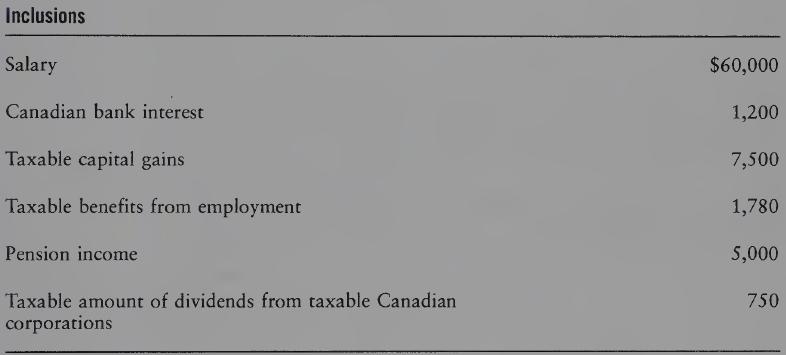

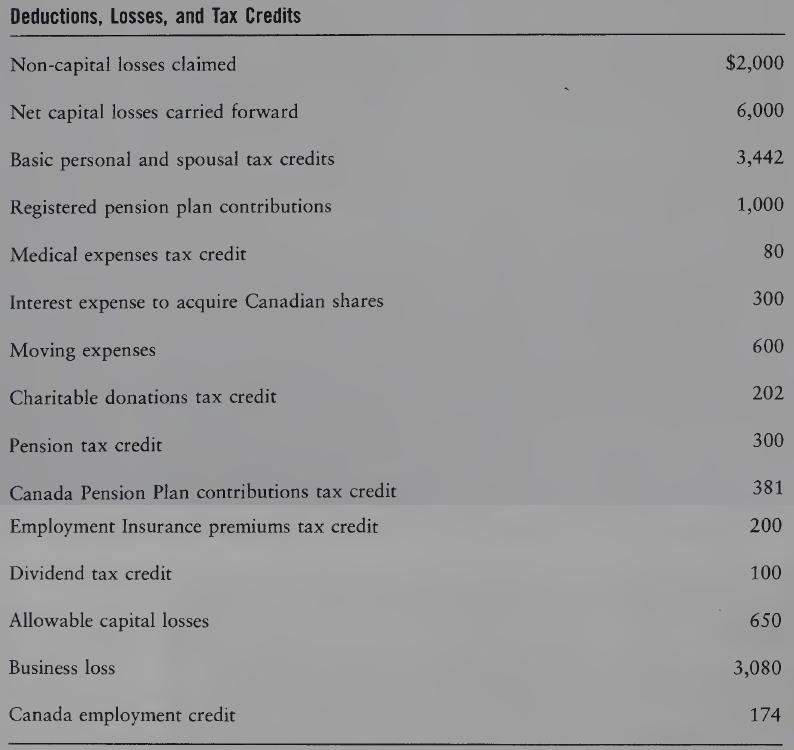

The following list of income inclusions, deductions, losses, and tax credits has been determined correctly by a

Question:

The following list of income inclusions, deductions, losses, and tax credits has been determined correctly by a junior staff accountant prior to the preparation of the tax return for Ms. Samara Lowen.

REQUIRED

(1) From the structural outlines and exhibits on the preceding pages, deter¬ mine the income, taxable income, and basic federal tax net of non-refundable tax credits based upon the above correct information using the ordering rules in sections 3, 111.1, and 118.92.

(2) Cross-reference each amount to the appropriate section of the Act. (Refer to Sectional List of the Act.)

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Introduction To Federal Income Taxation In Canada 2016-2017

ISBN: 9781554968725

37th Edition

Authors: Robert E. Beam, Stanley N. Laiken, James J. Barnett

Question Posted: