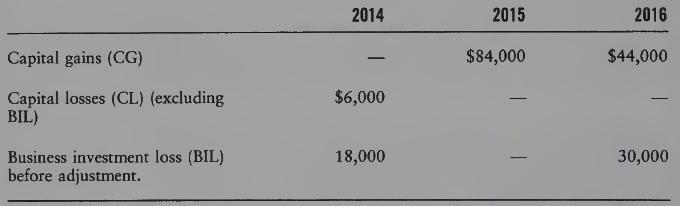

The following information has been provided by your client, Karl Kraft: Additional Information (1) Karl had a

Question:

The following information has been provided by your client, Karl Kraft:

Additional Information

(1) Karl had a $10,000 net capital loss which arose in 1998, and has not been deducted previously.

(2) Karl had no capital gains prior to 2014 and he did not claim any net capital losses in any preceding years.

(3) In 2015, Karl had a rental property loss of $1,000 and had no property income in 2014 or 2015.

REQUIRED

(1) Determine Karl’s income from the sources indicated for 2014 to 2016 according to the ordering rules in section 3.

(2) Determine Karl’s taxable income from the sources indicated for 2014 to 2016 according to the ordering rules in Division C after amending the returns.

Step by Step Answer:

Introduction To Federal Income Taxation In Canada 2016-2017

ISBN: 9781554968725

37th Edition

Authors: Robert E. Beam, Stanley N. Laiken, James J. Barnett