Bruce plc (Bruce), an Irish-listed company that prepares its financial statements to 31 December each year, sells

Question:

Bruce plc (“Bruce”), an Irish-listed company that prepares its financial statements to 31 December each year, sells products to those involved in magic and illusion.

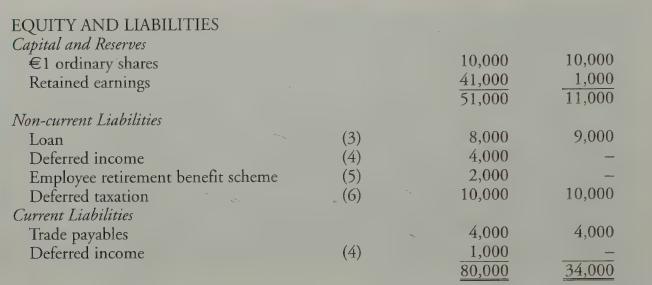

Additional Information: J an The directors of Bruce have decided to record the company’s property, plant and equipment at fair value rather than depreciated historical cost. The fair value of the property at 31 December 2017 is deemed to be €50,000,000, while the fair value of plant and equipment on the same date is €25,000,000.

. Development costs are capitalised and amortised over future periods in determining accounting profit but deducted in determining taxable profit in the period in which they are incurred.

. During the year ended 31 December 2017, Bruce negotiated a new loan with repayments commencing in 2019. For accounting purposes, the loan has been recorded net of the associated transaction costs paid in 2017. These costs are allowable for tax in the year in which they are paid.

. The deferred income relates to a non-taxable government grant received by Bruce.

. Employee retirement benefit costs are deducted in determining accounting profit when .

the service is provided by the employees, but deducted in determining taxable profit when contributions or retirement benefits are paid by Bruce.

. This represents the deferred taxation liability at 31 December 2016. During the year ended 31 December 2017, the taxation rate changed from 25% to 20%.

Bruce’s employee retirement benefit scheme is managed by the same investment bank that negotiated the new loan raised during 2017 (see Note 3). Furthermore, one of the investment managers in the investment bank is also a non-executive director of Bruce. During the year ended 31 December 2017, Bruce paid €7,000,000 into the employee retirement benefit scheme and paid fees amounting to €300,000 to the investment bank in relation to the administration of the employee retirement benefit scheme. In addition, during 2017 the investment manager received €20,000 from Bruce for his services as a nonexecutive director. This fee was paid to all non-executive directors.

Requirement

(a) Calculate the deferred taxation expense to be included in the statement of profit or loss and other comprehensive income of Bruce for the year ended 31 December 2017 and the deferred taxation liability as at that date.

(b) Discuss whether Bruce’s relationship and transactions with the investment bank should be disclosed in the financial statements for the year ended 31 December 2017.

Step by Step Answer:

International Financial Accounting And Reporting

ISBN: 9781912350025

6th Edition

Authors: Ciaran Connolly