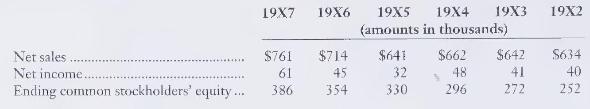

Net sales, net income, and common stockholders' equity for Bear Utilities, Inc., for a six-year period follow.

Question:

Net sales, net income, and common stockholders' equity for Bear Utilities, Inc., for a six-year period follow.

\section*{Required}

1. Compute trend percentages for each item for \(19 \times 3\) through \(19 \times 7\). Use \(19 \times 2\) as the base year.

2. Compute the rate of return on average common stockholders' equity for \(19 \mathrm{X} 3\) through \(19 \mathrm{X} 7\), rounding to three decimal places. In this industry, rates of 13 percent are average, rates above 16 percent are considered good, and rates above 20 percent are viewed as outstanding.

3. How does Bear's return on common stockholders' equity compare with the industry?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial Accounting

ISBN: 9780133118209

2nd Edition

Authors: Charles T. Horngren, Jr. Harrison, Walter T.

Question Posted: