On 1 January 2015, Citizen ple (Citizen) acquired all of the ordinary share capital of an Australian

Question:

On 1 January 2015, Citizen ple (“Citizen”) acquired all of the ordinary share capital of an Australian company, Kane Limited (“Kane”). Citizen's presentation currency is the Euro (€).

Kane operates independently of Citizen and its functional currency is the Australian dollar (A$).

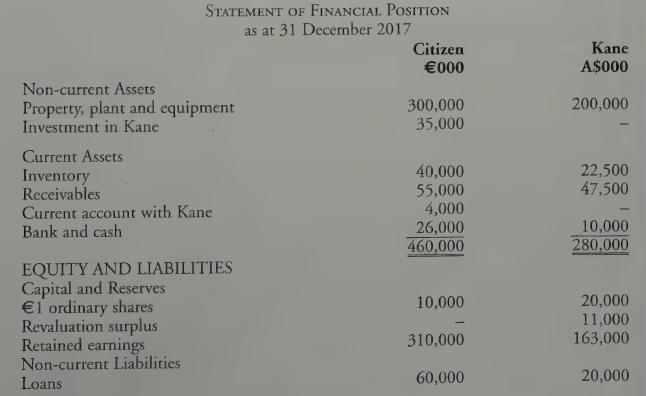

At the date of acquisition the retained earnings of Kane were A$45,000,000. The statements of profit or loss and other comprehensive income of Citizen and Kane for the year ended 31 December 2017 and their statements of financial position as that date are as follows

Additional Information:

1. All of Kane’s property, plant and equipment were acquired on or before 1 January 2015.

The revaluation surplus relates to the revaluation of property on 1 January 2015 in accordance with group policy.

2. Kane’s opening and closing inventory was purchased on 1 December 2016 and 1 December 2017 respectively.

3. Exchange rates were as follows

4. During 2017, goodwill arising on the acquisition of Kane was impaired for the first time by A$400,000.

Requirement ;

(a) Prepare the consolidated statement of profit or loss and other comprehensive income of Citizen for the year ended 31 December 2017 and the consolidated statement of finan-—

cial position as at that date.

(b) Show how the profit/loss on exchange differences arose in Citizen’s consolidated financial statements for the year ended 31 December 2017.

Step by Step Answer:

International Financial Accounting And Reporting

ISBN: 9781912350025

6th Edition

Authors: Ciaran Connolly