On January 1, 1990, Northwood Company purchased (80 %) of Souther Company's outstanding stock at ($ 48)

Question:

On January 1, 1990, Northwood Company purchased \(80 \%\) of Souther Company's outstanding stock at \(\$ 48\) per share. On that date, Northwood Company had retained earnings of \(\$ 517,500\). Souther Company had retained earnings of \(\$ 135,000\), and had outstanding 15,000 shares of \(\$ 15\) par, common stock, originally issued at par.

\section*{Part 1.}

\section*{Required}

1. Give the elimination entry to be used on a work sheet for a consolidated balance sheet dated January 1, 1990 .

2. Determine the amount of consolidated retained earnings that should be shown on a consolidated balance sheet dated January 1, 1990.

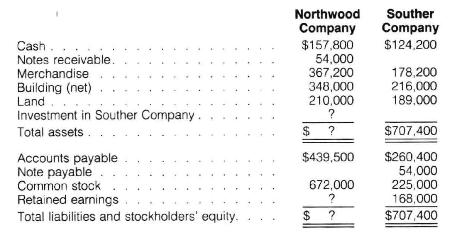

Part 2. During the year ended December 31, 1990, Northwood Company paid cash dividends of \(\$ 67,500\) and earned net income of \(\$ 127,500\) excluding earnings from its investment in Souther Company. Souther Company earned net income of \(\$ 63,000\) and paid dividends of \(\$ 30,000\). Except for Northwood Company's Retained Earnings account and the Investment in Souther Company account, the balance sheet accounts for the two companies on December 31, 1990, are as follows:

Northwood Company loaned \(\$ 54,000\) to Souther Company during 1990, for which Souther Company signed a note. On December 31, 1990, the note had not been repaid.

\section*{Required}

1. Calculate the December 31, 1990, balances in Northwood Company's Investment in Souther Company account and Retained Earnings account.

2. Complete a work sheet to consolidate the balance sheets of the two companies.

Step by Step Answer: