On January 1, 1990, Larger Company purchased (90 %) of Smaller Company's outstanding stock at ($ 24)

Question:

On January 1, 1990, Larger Company purchased \(90 \%\) of Smaller Company's outstanding stock at \(\$ 24\) per share. On that date, Larger Company had retained earnings of \(\$ 350,500\). Smaller Company had retained earnings of \(\$ 225,000\), and had outstanding 20,000 shares of \(\$ 10\) par, common stock, originally issued at par.

\section*{Part 1.}

\section*{Required}

1. Give the elimination entry to be used on a work sheet for a consolidated balance sheet dated January 1, 1990.

2. Determine the amount of consolidated retained earnings that should be shown on a consolidated balance sheet dated January 1, 1990.

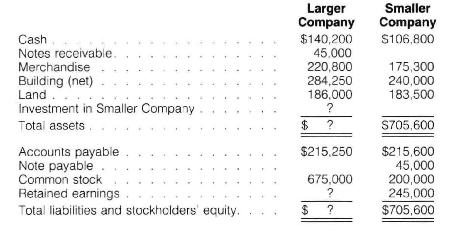

Part 2. During the year ended December 31, 1990, Larger Company paid cash dividends of \(\$ 45,000\) and earned net income of \(\$ 90,000\) excluding earnings from its investment in Smaller Company. Smaller Company earned net income of \(\$ 45,000\) and paid dividends of \(\$ 25,000\). Except for Larger Company's Retained Earnings account and the Investment in Smaller Company account, the balance sheet accounts for the two companies on December 31, 1990, are as follows:

Larger Company loaned \(\$ 45,000\) to Smaller Company during 1990, for which Smaller Company signed a note. On December 31, 1990, the note had not been repaid.

\section*{Required}

1. Calculate the December 31, 1990, balances in Larger Company's Investment in Smaller Company account and Retained Earnings account.

2. Complete a work sheet to consolidate the balance sheets of the two companies.

Step by Step Answer: