Ridder Company's payroll taxes and fringe benefit expenses include unemployment taxes of (0.8 %) (federal) and (4.0

Question:

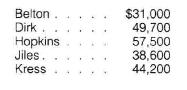

Ridder Company's payroll taxes and fringe benefit expenses include unemployment taxes of \(0.8 \%\) (federal) and \(4.0 \%\) (state) on the first \(\$ 7,000\) of each employee's salary, FICA taxes of \(7.5 \%\) on the first \(\$ 45,000\), retirement fund contributions of \(10 \%\) of total earnings, and health insurance premiums of \(\$ 180\) per employee per month. Given the following list of employee salaries, payroll taxes and fringe benefits constitute what percentage of salaries?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: