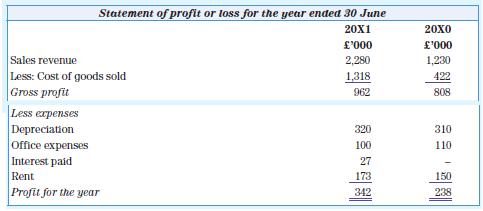

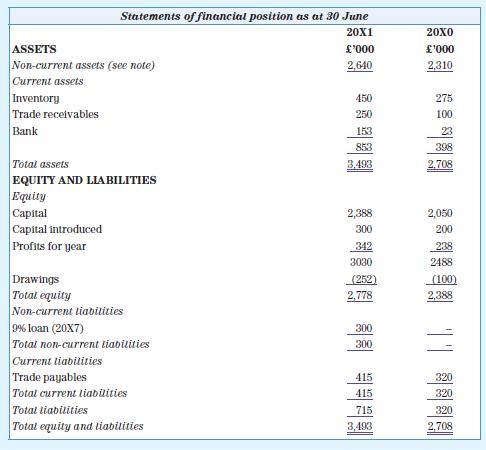

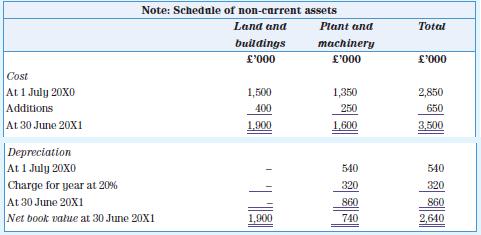

The following are the financial statements for A. Tack for the years ended 30 June 20X1 and

Question:

The following are the financial statements for A. Tack for the years ended 30 June 20X1 and 20X0:

Required

Prepare a statement of cash flows in accordance with IAS 7 for A. Tack for the year ended 30 June 20X1.

Transcribed Image Text:

Statement of profit or loss for the year ended 30 June 20X1 £'000 2,280 1,318 962 Sales revenue Less: Cost of goods sold Gross profit Less expenses Depreciation Office expenses Interest paid Rent Profit for the year 320 100 27 173 342 20X0 £'000 1,230 422 808 310 110 150 238

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 30% (10 reviews)

ANSWER Here is a table summarizing the A Tack Statement of Cash Flows for the year ended 30 ...View the full answer

Answered By

Akash M Rathod

I have been utilized by educators and students alike to provide individualized assistance with everything from grammar and vocabulary to complex problem-solving in various academic subjects. I can provide explanations, examples, and practice exercises tailored to each student's individual needs, helping them to grasp difficult concepts and improve their skills.

My tutoring sessions are interactive and engaging, utilizing a variety of tools and resources to keep learners motivated and focused. Whether a student needs help with homework, test preparation, or simply wants to improve their skills in a particular subject area, I am equipped to provide the support and guidance they need to succeed.

0.00

0 Reviews

10+ Question Solved

Related Book For

Introduction To Financial Accounting

ISBN: 9781526803009

9th Edition

Authors: Anne Marie Ward, Andrew Thomas

Question Posted:

Students also viewed these Business questions

-

Getty Company expects sales for the first three months of next year to be $215,000, $245,000 and $295,000, respectively. Getty expects 30 percent of its sales to be cash and the remainder to be...

-

The following are the financial statements for S. Low for the years ended 30 April 20X0 and 30 April 20X1: Required Prepare a statement of cash flows in accordance with IAS 7 for S. Low for the year...

-

T. Bone is a sole trader and reports the following for the year ended 30 June 20X1: 1. The 20X0 allowance for irrecoverable receivables was 600. 2. The 20X1 allowance for irrecoverable receivables is...

-

Show that an emission tax and an absolute emission standard are equivalent instruments to regulate a polluting monopolist if and only if the standard is binding.

-

Robinson Crusoe has decided that he will spend exactly 8 hours a day gathering food. He can either spend this time gathering coconuts or catching fish. He can catch 1 fish per hour and he can gather...

-

Karen Johnson, CFO for Raucous Roasters (RR), a specialty coffee manufacturer, is rethinking her company's working capital policy in light of a recent scare she faced when RR's corporate banker,...

-

How would the value chain approach to internal analysis be used? (R-56)

-

Two oppositely charged. Identical insulating spheres, each 50.0 cm in diameter and carrying a uniform charge of magnitude 175 µC are placed 1.00 m apart center to center (Fig). (a) If a...

-

Which of the following is NOT a component of a situational profile? Personality Stage of life Measure of wealth Source of wealth

-

The Baldwin Company wants to decrease its plant utilization for Buzz by 15%. How many units would need to be produced next year to meet this production goal? Ignore impact of accounts payable on...

-

A. Net is a sole trader and reports the following for the year ended 31 December 20X9: Required Prepare the statement of cash flows in accordance with IAS 7 for A. Net for the year ended 31 December...

-

The following are the statements of financial position of A. Brooks as at 30 June 20X0 and 30 June 20X1: Additional information 1. There were no disposals of non-current assets during the year. 2....

-

Classify the following transactions and economic events for Sayabec Ltd. as commitments, subsequent events, or contingent liabilities . Some may fit more than one classification. Indicate how each...

-

You will be creating a Performance Improvement Plan to address an employee in the attached case study (see below). This is a scenario you may encounter in your future HR profession, so this...

-

For this prompt, consider your academic goals, including (but not limited to) such topics as how you plan to manage your time to fit in your studies; how you will build your skills, as needed; how...

-

1. An introduction of you as a leader (whether or not you see yourself as a leader, whether or not you like being a leader, what kinds of leadership roles you have had, etc.). 2. Summarize your...

-

Briefly, describe the firm in terms of the following items. a. Size in terms of market capitalization, annual revenue, number of employees, location(s). b. Discuss the financial position of the firm....

-

HealthyLife (HL) is a publicly-traded company in the Food Manufacturing Industry. HealthyLife has been around since the 1970s, and is mainly focused on the production and wholesale of "organic and...

-

Use any method (including geometry) to find the area of the following regions. In each case, sketch the bounding curves and the region in question. The region in the first quadrant bounded by y = 2...

-

This problem continues the Draper Consulting, Inc., situation from Problem 12-45 of Chapter 12. In October, Draper has the following transactions related to its common shares: Oct 1 Draper...

-

Northend Motors sold a new BMW to Salvador Frezatti. The list price of the new car was $40,000. Mr. Frezatti traded in a 5-year old Audi that has a Blue Book value of $15,000. Northend also offered a...

-

The Good Samaritan Hospital uses the allowance method in accounting for bad debts. A journal entry was made for writing off the accounts of Jane Peterson, Eunice Belmont, and Samuel Goldman. Do you...

-

Vulcan Materials Company , the nations largest producer of construction aggregates, is head-quartered in Birmingham, Alabama. The company had 2011 sales of $2,565 million. Beginning and ending net...

-

What is the present value of $500 invested each year for 10 years at a rate of 5%?

-

GL1203 - Based on Problem 12-6A Golden Company LO P2, P3 Golden Corp.'s current year income statement, comparative balance sheets, and additional information follow. For the year, (1) all sales are...

-

A project with an initial cost of $27,950 is expected to generate cash flows of $6,800, $8,900, $9,200, $8,100, and $7,600 over each of the next five years, respectively. What is the project's...

Study smarter with the SolutionInn App