Veronica is the owner of a manufacturing business. The following trial balance was extracted from her books

Question:

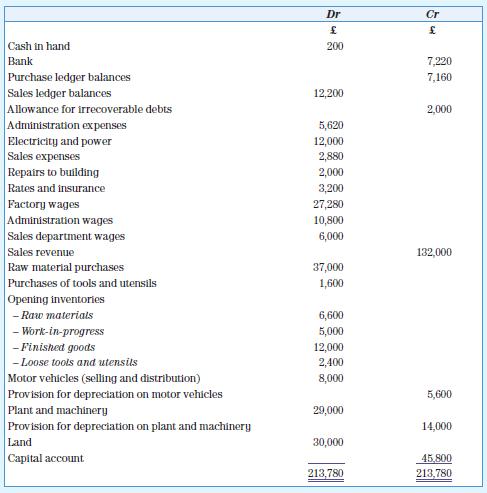

Veronica is the owner of a manufacturing business. The following trial balance was extracted from her books as at 31 December 20X4:

The following information was also made available:

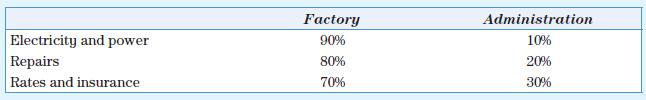

1. Expenses are to be allocated as follows:

2. Closing inventories included: raw materials £5,600; loose tools and utensils £3,200; finished goods £7,800; and work-in-progress £5,000.

3. Irrecoverable debts amounting to £1,000 are to be written off and the allowance for irrecoverable debts reduced to £1,200.

4. The following amounts have yet to be provided for in the trial balance: electricity and power £1,600 and new machinery £1,000.

5. The following amounts have been prepaid as at the year end: rates £600 and vehicle licences on sales representatives’ cars £80.

6. A vehicle costing £3,000 and written down to £1,000 was sold for £1,200. None of these entries have been recorded in the trial balance as the bookkeeper did not know how to adjust for the sale.

7. Annual depreciation on plant and machinery and on motor vehicles is to be provided using the reducing balance method. The rates used for each class of asset are 15 per cent (plant and machinery) and 20 per cent (motor vehicles).

8. An invoice for £200 for repairs to the building had been incorrectly posted to the administration expenses account.

9. A building costing £100,000 was purchased using a long-term loan on 1 January 20X4. Interest payable on the loan is 10 per cent per year. No entries for this transaction have been included in the trial balance. It has been decided to depreciate buildings at 5 per cent on cost.

Required

Prepare the following:

a. The manufacturing account and the statement of profit or loss for the year ended 31 December 20X4.

b. The statement of financial position as at 31 December 20X4.

Step by Step Answer:

Introduction To Financial Accounting

ISBN: 9781526803009

9th Edition

Authors: Anne Marie Ward, Andrew Thomas