Walnut Lubricants is considering a change from the LIFO inventory method to the FIFO method. Managers are

Question:

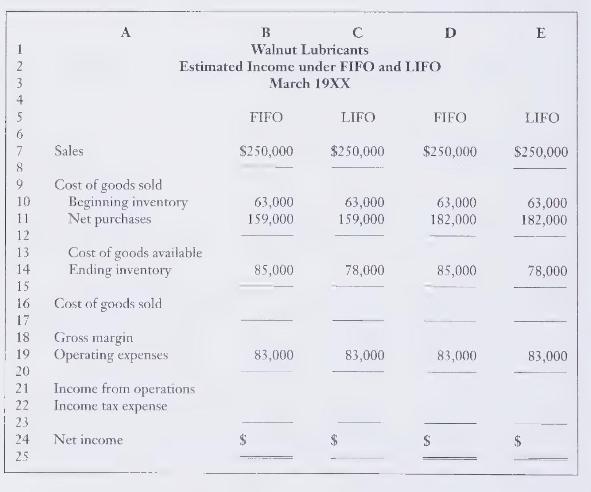

Walnut Lubricants is considering a change from the LIFO inventory method to the FIFO method. Managers are concerned about the effect of this change on income tax expense and reported net income. If the change is made, it will become effective on March 1. Inventory on hand at February 28 is \(\$ 63,000\). During March, Walnut managers expect sales of \(\$ 250,000\), net purchases between \(\$ 159,000\) and \(\$ 182,000\), and operating expenses, excluding income tax, of \(\$ 83,000\). The income tax rate is 30 percent. Inventories at March 31 are budgeted as follows: FIFO, \(\$ 85,000\); LIFO, \(\$ 78,000\).

\section*{Required}

Create a spreadsheet model to compute estimated net income for March under FIFO and LIFO. Format your answer as follows:

Step by Step Answer:

Financial Accounting

ISBN: 9780133118209

2nd Edition

Authors: Charles T. Horngren, Jr. Harrison, Walter T.