Bitburger Brewery, Germany, allocates all central corporate overhead costs to its divisions. Some costs such as specified

Question:

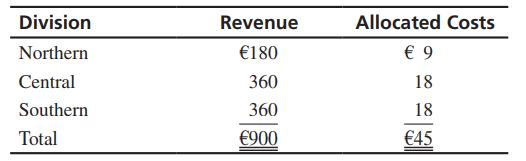

Bitburger Brewery, Germany, allocates all central corporate overhead costs to its divisions. Some costs such as specified internal auditing and legal costs are identified on the basis of time spent. However, other costs are hard to allocate, so the revenue achieved by each division is used as an allocation base. Examples of such costs are executive salaries, travel, secretarial, utilities, depreciation, corporate planning, and general marketing costs. The company has divided its countrywide business operation into three divisions namely Northern Division, Central Division, and Southern Division.

Allocations on the basis of revenue for 2019 are as follows (in millions):

In 2020, Northern Division’s revenue remained unchanged. However, Southern Division’s revenue increased to €390 million due to large corporate orders. The latter are troublesome to forecast. Central Division had expected a sharp rise in revenue, but severe competing conditions resulted in a decline to €330 million. The total central corporate overhead cost allocated on the basis of revenue was again €45 million, despite rises in many other costs. The CEO was pleased that central costs did not rise for the year.

1. Compute the allocations of cost for each division for 2020.

2. How would each division manager probably feel about the cost allocation in 2020 as compared to 2019? What are the weaknesses of using revenue as a basis of cost allocation?

3. Suppose the budgeted revenues for 2020 were €180, €360, and €420 million respectively, and the budgeted revenues were used as a cost allocation base for allocation. Compute the allocations of costs to each division for 2020. Do you prefer this method to the one used in number 1? Why?

4. Many accountants and managers oppose allocating any central costs. Why?

Step by Step Answer:

Introduction To Management Accounting

ISBN: 9781292412566

17th Edition, Global Edition

Authors: Charles Horngren, Gary L Sundem, Dave Burgstahler