Two of Whirlaw Industries divisions are the $ Division and the B Division. The B Division has

Question:

Two of Whirlaw Industries’ divisions are the $ Division and the B Division. The B Division has developed a new product that uses a component that the S Division produces.

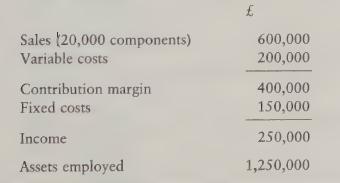

The S Division is currently selling 20,000 of the components to outside customers and still has enough excess capacity to fill B’s order for 5,000 components. The selling price to outside customers is £30 each. The B Division has obtained bids from other component suppliers and has a bid of £25 for the component. Therefore, the B Division has indicated that it will not buy from the $ Division unless the price is dropped to £25. The manager of the S$ Division has prepared the following annual budget relating to the component and excluding any sales to the B Division.

Divisional managers are evaluated using RI with a required return of 10%.

Required

(a) Determine the minimum price the selling division could accept and not adversely affect RI.

(b) Determine the maximum the buying division would be willing to pay.

(c) Determine whether it is in the firm’s best interests for the transfer to take place.

(d) If the § Division was at capacity, how would this affect your analysis? Determine the minimum the S Division could now accept without adversely affecting residual income.

(ec) Determine whether it is in the firm’s best interests for the transfer to take place between divisions if the $ Division is at capacity.

Step by Step Answer: