Evaluating profit impact of alternative transfer decisions (adapted from CM A exam). Keller Company manufactures a line

Question:

Evaluating profit impact of alternative transfer decisions (adapted from CM A exam). Keller Company manufactures a line of men's colognes and after-shave lotions.

The firm manufactures the products through a series of mixing operations with the addition of certain aromatic and coloring ingredients; the firm packages the finished product in a company-produced glass bottle and packs it in cases containing six bottles.

Management of Keller believes appearance of the bottle heavily influences the sale of its product. Management has developed a unique bottle of which it is quite proud.

Cologne production and bottle manufacturing have evolved over the years in an almost independent manner; in fact, a rivalry has developed between management personnel as to which division is the more important to Keller. This attitude is probably intensified because the bottle manufacturing plant was purchased intact 10 years ago, and no real interchange of management personnel or ideas (except at the top corporate level) has taken place.

Since the acquisition, the cologne manufacturing plant has absorbed all bottle production.

Management considers each area a separate profit center and evaluates each area as a separate profit center. As the new corporate controller, you are responsible for the definition of a proper transfer value to use in crediting the bottle production profit center and in debiting the packaging profit center.

At your request, the bottle division general manager has asked certain other bottle manufacturers to quote a price for the quantity and sizes the cologne division demands.

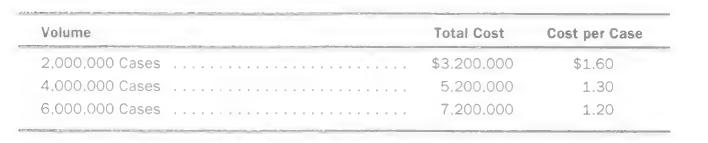

These competitive prices follow:

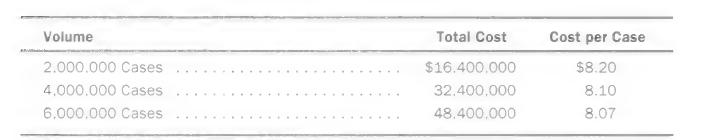

A cost analysis of the internal bottle plant indicates that it can produce bottles at these costs:

These costs include fixed costs of SI ,200.000 and variable costs of SI per case.

These figures resulted in discussion about the proper value to use in the transfer of bottles to the cologne division. Corporate executives are interested because a significenterc a nrte psourltitosn. of a division manager's income is an incentive bonus based on profit The cologne production division incurred the following costs in addition to the bottle costs:

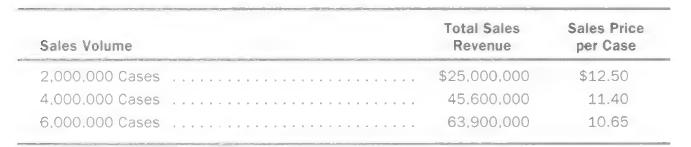

After considerable analysis, the marketing research department furnishes you with the following price-demand relation for the finished product:

a. The Keller Company has used market-based transfer prices in the past. Using the current market prices and costs, and assuming a volume of 6.000,000 cases, calculate the income for (1) The bottle division.

(2) The cologne division.

(3) The corporation.

b. Is this production and sales level the most profitable volume for (1) The bottle division?

(2) The cologne division'.'

(3) The corporation?

Explain your answer.

Step by Step Answer:

Managerial Accounting An Introduction To Concepts Methods And Uses

ISBN: 9780030259630

7th Edition

Authors: Michael W. Maher, Clyde P. Stickney, Roman L. Weil, Sidney Davidson