Market-Value Transfer Price. Epsilon Company has two divisions, (M) and (S). Division (mathrm{M}) manufactures a product, and

Question:

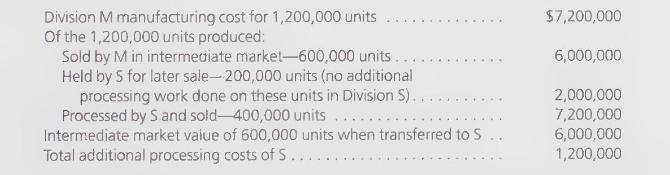

Market-Value Transfer Price. Epsilon Company has two divisions, \(M\) and \(S\). Division \(\mathrm{M}\) manufactures a product, and Division \(\mathrm{S}\) sells it. The intermediate market is competitive. But the product can be processed further and sold or stored for later processing and sale. Once the product is manufactured, some of it is sold by Division \(\mathrm{M}\); and some is transferred to Division \(\mathrm{S}\) which decides whether to hold or to process and sell the product. The following information pertains to the current year:

\section*{Required:}

1. Prepare an income statement for the whole firm.

2. Prepare a separate income statement for each division using a cost-based transfer price.

3. Prepare a separate income statement for each division using a market-value transfer price.

Step by Step Answer:

Managerial Accounting

ISBN: 9780538842822

9th Edition

Authors: Harold M. Sollenberger, Arnold Schneider, Lane K. Anderson