Net present value graph and indifference cost of capital. Gregory and Georgia Financial Consulting Firm's after-tax net

Question:

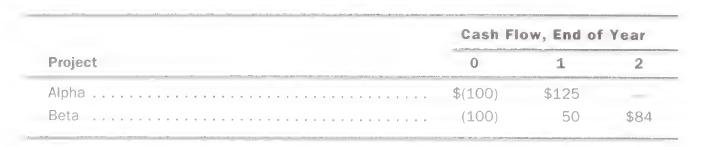

Net present value graph and indifference cost of capital. Gregory and Georgia Financial Consulting Firm's after-tax net cash flows associated with two mutually exclusive projects. Alpha and Beta, are as follows:

a. Calculate the net present value For each project using discount rates of 0, 0.04, 0.08,0.110.15,0.20, and 0.25.

b. Prepare a graph as follows. Label the vertical axis "Net Present Value in Dollars"

and the horizontal axis "Discount Rate in percent per Year." Plot the net present value amounts calculated in part a for project Alpha and project Beta.

c. State the decision rule for choosing between projects Alpha and Beta as a function of the firm's cost of capital.

d. What generalizations can you draw from this exercise 7

Step by Step Answer:

Managerial Accounting An Introduction To Concepts Methods And Uses

ISBN: 9780030259630

7th Edition

Authors: Michael W. Maher, Clyde P. Stickney, Roman L. Weil, Sidney Davidson