Question:

Outdoor Products Inc. produces extreme-weather sleeping bags. The company applies variable manufacturing overhead at a standard rate of \($2\) per direct labor hour. The standard quantity of direct labor is 3 hours per unit. Variable overhead costs totaled \($32,000\) for the month of September. A total of 14,700 direct labor hours were worked during September to produce 5,100 sleeping bags.

Required

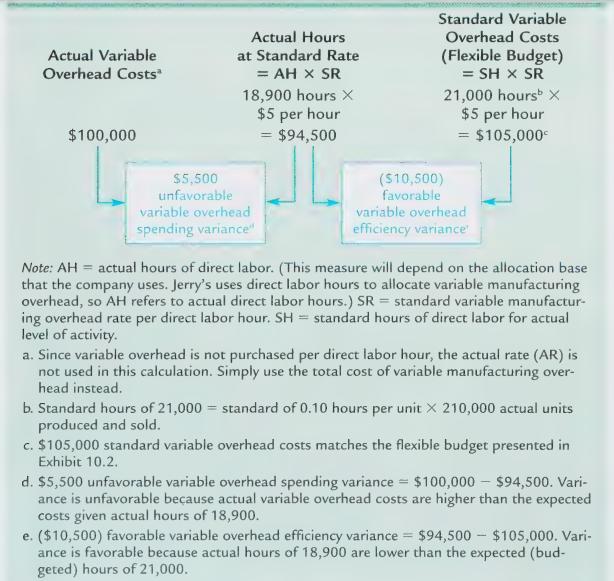

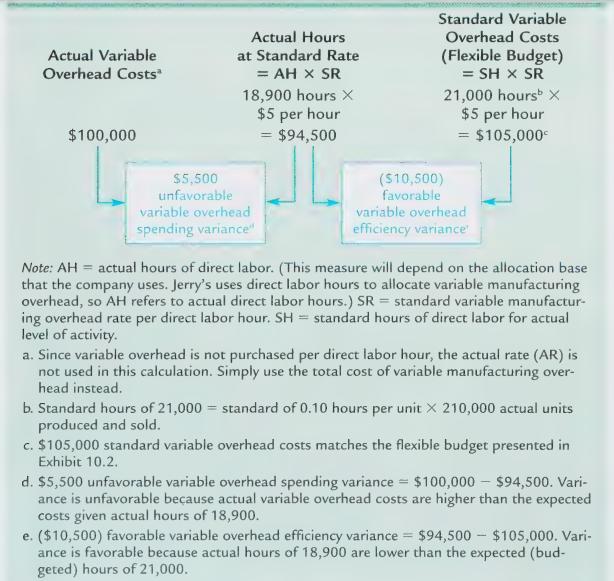

Calculate the variable overhead spending variance and variable overhead efficiency variance using the format shown in Exhibit 10.5. Clearly label each variance as favorable or unfavorable.

Exhibit 10.5

Transcribed Image Text:

Actual Variable Overhead Costs $100,000 $5,500 unfavorable Actual Hours at Standard Rate = AH X SR 18,900 hours X $5 per hour = = $94,500 ($10,500) favorable Standard Variable Overhead Costs (Flexible Budget) = SH X SR 21,000 hours X $5 per hour = $105,000 variable overhead Note: AH variable overhead spending variance" efficiency variance actual hours of direct labor. (This measure will depend on the allocation base that the company uses. Jerry's uses direct labor hours to allocate variable manufacturing overhead, so AH refers to actual direct labor hours.) SR = standard variable manufactur- ing overhead rate per direct labor hour. SH = standard hours of direct labor for actual level of activity. a. Since variable overhead is not purchased per direct labor hour, the actual rate (AR) is not used in this calculation. Simply use the total cost of variable manufacturing over- head instead. b. Standard hours of 21,000 standard of 0.10 hours per unit X 210,000 actual units produced and sold. c. $105,000 standard variable overhead costs matches the flexible budget presented in Exhibit 10.2. d. $5,500 unfavorable variable overhead spending variance = $100,000 - $94,500. Vari- ance is unfavorable because actual variable overhead costs are higher than the expected costs given actual hours of 18,900. e. ($10,500) favorable variable overhead efficiency variance = $94,500 - $105,000. Vari- ance is favorable because actual hours of 18,900 are lower than the expected (bud- geted) hours of 21,000.