Consider the regression model (W A G E=beta_{1}+beta_{2} E D U C+e). WAGE is hourly wage rate

Question:

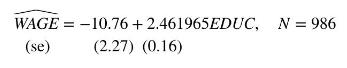

Consider the regression model \(W A G E=\beta_{1}+\beta_{2} E D U C+e\). WAGE is hourly wage rate in U.S. 2013 dollars. \(E D U C\) is years of education attainment, or schooling. The model is estimated using individuals from an urban area.

a. The sample standard deviation of \(W A G E\) is 15.96 and the sum of squared residuals from the regression above is 199,705.37. Compute \(R^{2}\).

b. Using the answer to (a), what is the correlation between WAGE and EDUC? [Hint: What is the correlation between \(W A G E\) and the fitted value \(\widehat{W A G E}\) ?]

c. The sample mean and variance of \(E D U C\) are 14.315 and 8.555, respectively. Calculate the leverage of observations with \(E D U C=5,16\), and 21 . Should any of the values be considered large?

d. Omitting the ninth observation, a person with 21 years of education and wage rate \(\$ 30.76\), and reestimating the model we find \(\hat{\sigma}=14.25\) and an estimated slope of 2.470095 . Calculate DFBETAS for this observation. Should it be considered large?

e. For the ninth observation, used in part (d), DFFITS \(=-0.0571607\). Is this value large? The leverage value for this observation was found in part (c). How much does the fitted value for this observation change when this observation is deleted from the sample?

f. For the ninth observation, used in parts (d) and (e), the least squares residual is -10.18368 . Calculate the studentized residual. Should it be considered large?

Step by Step Answer:

Principles Of Econometrics

ISBN: 9781118452271

5th Edition

Authors: R Carter Hill, William E Griffiths, Guay C Lim