Do lags of the variables in the new Keynesian Phillips curve provide a good basis for forecasting

Question:

Do lags of the variables in the new Keynesian Phillips curve provide a good basis for forecasting quarterly inflation? In this exercise, we investigate this question using the French data from Amberger et al. See Exercise 9.34 for details. The data are stored in the data file france.

a. Consider ARDL models of the form

Using observations from 1991Q1 to 2013Q4, estimate this equation for \(p=2, q=1,2,3,4\) and \(m=1,2,3,4\). From these 16 equations, select and report the one with the smallest value of the Schwarz criterion. Note that 92 observations should be used to estimate each equation.

b. In the equation selected in part (a), are all the estimated coefficients significantly different from zero at a 5\% significance level? Does the correlogram suggest that there is no autocorrelation in the errors?

c. Use the selected model from part (a) to find \(95 \%\) forecast intervals for inflation in 2014Q1, 2014Q2, 2014Q3, and 2014Q4. When computing the forecasts, use actual values of INFEX and GAP where needed but assume that the actual values of \(I N F\) in the four forecast quarters are unknown. After you have found the forecast intervals, check whether the actual values lie within those intervals.

![]()

You might like to prove this result.

d. What assumptions are necessary for the standard errors of the forecast errors to be valid?

Data From Exercise 9.34:-

One way of modeling supply response for an agricultural crop is to specify a model in which area planted AREA depends on expected price, PRICE*. A log-log (constant elasticity) version of this model is \(\ln \left(\right.\) AREA \(\left._{t}\right)=\alpha+\gamma \ln \left(\right.\) PRICE \(\left._{t+1}^{*}\right)+e_{t}\) where PRICE \({ }_{t+1}^{*}\) is expected price in the next period when harvest takes place. When farmers expect price to be high, they plant more than when a low price is expected. Since they do not know the price at harvest time, we assume that they base their expectations on current and past prices, \(\ln \left(P R I C E_{t+1}^{*}\right)=\sum_{s=0}^{q} \gamma_{s} \ln \left(P R I C E_{t-s}\right)\), with more recent prices given a greater weight, \(\gamma_{0}>\gamma_{1}>\cdots>\gamma_{q}\). We use this model to explain the area of sugar cane planted in a region of the Southeast Asian country of Bangladesh. Information on the delay and interim elasticities is useful for government planning. It is important to know whether existing sugar processing mills are likely to be able to handle predicted output, whether there is likely to be excess milling capacity, and whether a pricing policy linking production, processing, and consumption is desirable. Data comprising 73 annual observations on area and price are given in the data file bangla5.

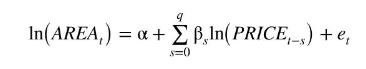

a. Let \(\beta_{s}=\gamma \gamma_{s}\). Show that the model can be written as the finite distributed lag model

b. Estimate the model in part (a) assuming \(q=3\). Use HAC standard errors. What are the estimated delay and interim elasticities? Comment on the results. What are the first four autocorrelations of the residuals? Are they significantly different from zero at a 5\% significance level?

c. You will have discovered that the lag weights obtained in part (a) do not satisfy a priori expectations. One way to try and overcome this problem is to insist that the weights lie on a straight line

![]()

If \(\alpha_{0}>0\) and \(\alpha_{1}

![]()

where \(z_{t 0}=\sum_{s=0}^{3} \ln \left(\right.\) PRICE \(\left._{t-s}\right)\) and \(z_{t 1}=\sum_{s=1}^{3} s \ln \left(P R I C E_{t-s}\right)\).

d. Create variables \(z_{t 0}\) and \(z_{t 1}\) and find least squares estimates of \(\alpha_{0}\) and \(\alpha_{1}\). Use HAC standard errors.

e. Use the estimates for \(\alpha_{0}\) and \(\alpha_{1}\) to find estimates for \(\beta_{s}=\alpha_{0}+\alpha_{1} s\) and comment on them. Has the original problem been cured? Do the weights now satisfy a priori expectations?

f. How do the delay and interim elasticities compare with those obtained earlier?

Step by Step Answer:

Principles Of Econometrics

ISBN: 9781118452271

5th Edition

Authors: R Carter Hill, William E Griffiths, Guay C Lim