The following financial statements were drawn from the records of Matrix Shoes: Income Statement For the Year

Question:

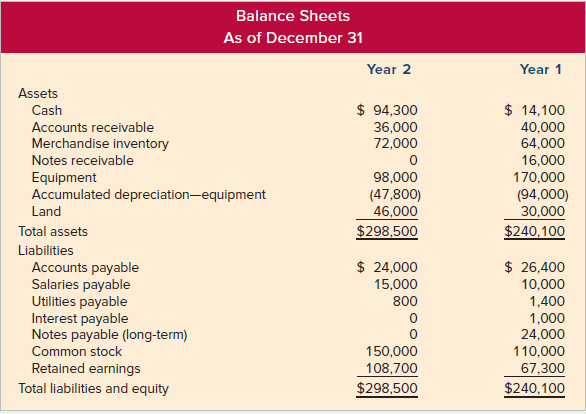

The following financial statements were drawn from the records of Matrix Shoes:

Income Statement For the Year Ended December 31, Year 2

Sales revenue ...................................................................$300,000

Cost of goods sold ...........................................................(144,000)

Gross margin .....................................................................156,000

Operating expenses

Salary expense ...................................................................(88,000)

Depreciation expense .........................................................(9,800)

Utilities expense ..................................................................(6,400)

Operating income ................................................................51,800

Nonoperating items

Interest expense ..................................................................(2,400)

Loss on the sale of equipment .............................................(800)

Net income ........................................................................$ 48,600

Additional Information

1. Sold equipment costing $72,000 with accumulated depreciation of $56,000 for $15,200 cash.

2. Paid a $7,200 cash dividend to owners.

Required

Analyze the data and prepare a statement of cash flows using the direct method.

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial... Dividend

A dividend is a distribution of a portion of company’s earnings, decided and managed by the company’s board of directors, and paid to the shareholders. Dividends are given on the shares. It is a token reward paid to the shareholders for their...

Step by Step Answer:

Introductory Financial Accounting for Business

ISBN: 978-1260299441

1st edition

Authors: Thomas Edmonds, Christopher Edmonds