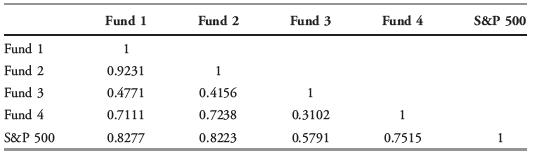

11. The following table shows the sample correlations between the monthly returns for four different mutual funds...

Question:

11. The following table shows the sample correlations between the monthly returns for four different mutual funds and the S&P 500. The correlations are based on 36 monthly observations. The funds are as follows:

Fund 1 Large-cap fund Fund 2 Mid-cap fund Fund 3 Large-cap value fund Fund 4 Emerging markets fund S&P 500 US domestic stock index

Test the null hypothesis that each of these correlations, individually, is equal to zero against the alternative hypothesis that it is not equal to zero. Use a 5 percent significance level.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: