Determine the client segment or adviser type that is most appropriate for each stage of Silis plan.

Question:

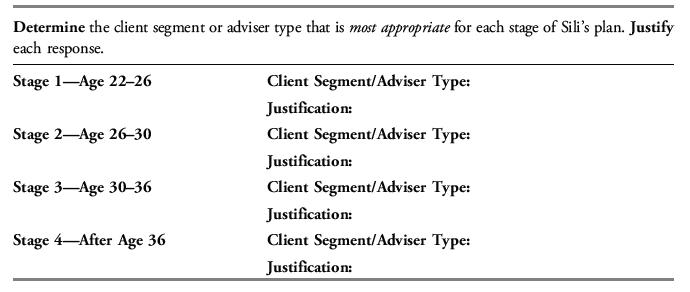

Determine the client segment or adviser type that is most appropriate for each stage of Sili’s plan. Justify each response.

Sili next uses three approaches to analyze his retirement goals:

Approach 1. Sili considers the probability that he will live to a certain age and then predicts his inflation-adjusted retirement spending according to the probability that he will still be living in a given year. This approach allows him to estimate the present value of his retirement spending needs by assigning associated probabilities to annual expected cash outflows.

Approach 2. Sili determines that he can specify his level of annual spending during retirement and that he can model that spending as a series of fixed payments. He calculates the present value of that series of payments as of the day of his retirement, resulting in the amount of money that he will need to fund his retirement goals.

Approach 3. Sili models the uncertainty of each key variable individually by assigning each one its own probability distribution and then generates a large number of random outcomes for each variable. He aggregates the outcomes to determine an overall probability of reaching his objectives. Sili sees this as a flexible approach that allows him to explore various scenarios, including unforeseen expenses.

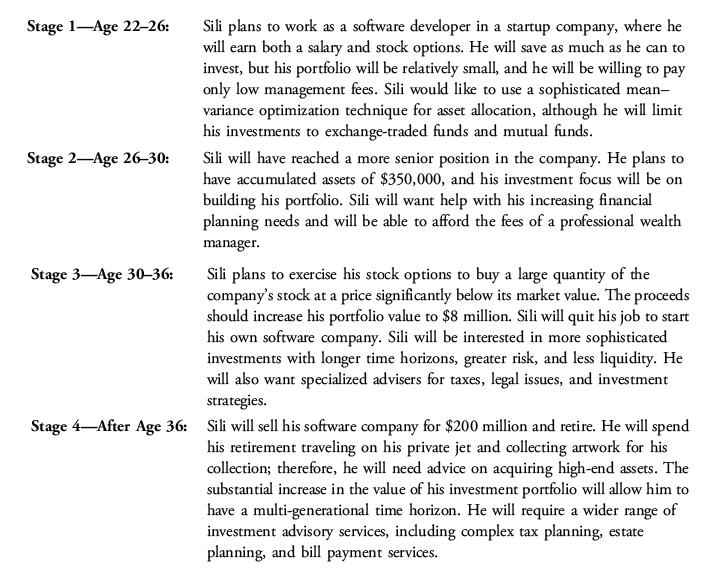

Val Sili, age 22, has just graduated from college and begins making ambitious future financial plans. The four stages of his plan are summarized below. Sili would like to have outside financial advice at each of these stages.

Step by Step Answer: