The most appropriate risk attribution approach for the fixed-income manager is to: A. decompose historical returns into

Question:

The most appropriate risk attribution approach for the fixed-income manager is to:

A. decompose historical returns into a top-down factor framework.

B. evaluate the marginal contribution to total risk for each position.

C. attribute tracking risk to relative allocation and selection decisions.

Alexandra Jones, a senior adviser at Federalist Investors (FI), meets with Erin Bragg, a junior analyst. Bragg just completed a monthly performance evaluation for an FI fixed-income manager. Bragg’s report addresses the three primary components of performance evaluation:

measurement, attribution, and appraisal. Jones asks Bragg to describe an effective attribution process. Bragg responds as follows:

Response 1: Performance attribution draws conclusions regarding the quality of a portfolio manager’s investment decisions.

Response 2: Performance attribution should help explain how performance was achieved by breaking apart the return or risk into different explanatory components.

Bragg notes that the fixed-income portfolio manager has strong views about the effects of macroeconomic factors on credit markets and follows a top-down investment process.

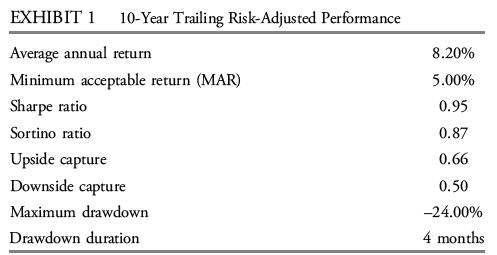

Jones reviews the monthly performance attribution and asks Bragg whether any riskadjusted historical performance indicators are available. Bragg produces the following data:

Step by Step Answer: