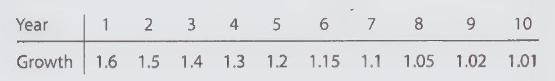

You are considering an investment in a tree farm. Trees grow each year by the following factors:

Question:

You are considering an investment in a tree farm. Trees grow each year by the following factors:

The price of lumber follows a binomial lattice with \(u=1.20\) and \(d=9\). The interest rate is constant at \(10 \%\). It costs \(\$ 2\) million each year, payable at the beginning of the year, to lease the forest land. The initial value of the trees is \(\$ 5\) million (assuming they were harvested immediately). You can cut the trees at the end of any year and then not pay rent after that. (For those readers who care, we assume that cut lumber can be stored at no cost.)

(a) Argue that if the rent were zero, you would never cut the trees as long as they were growing.

(b) With rent of \(\$ 2\) million per year, find the best cutting policy and the value of the investment opportunity.

Step by Step Answer: