In Figure 95, Security As beta of 1.5 indicates that, on average, Security As returns exhibit 1.5

Question:

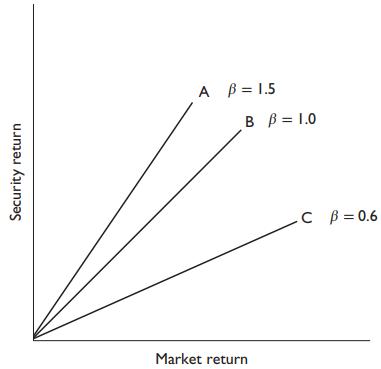

In Figure 9‐5, Security A’s beta of 1.5 indicates that, on average, Security A’s returns exhibit 1.5 times the average sensitivity to market return changes, both up and down. A security whose returns rise or fall on average 15 percent when the market return rises or falls 10 percent is said to be an aggressive, or risky, security. If the line is less steep than the 45‐degree line, beta is less than 1.0; this indicates that on average, a stock’s returns have less sensitivity than average to market moves. For example, Security C’s beta of 0.6 indicates that stock returns move up or down, on average, only 60 percent as much as the market as a whole.

Figure 9‐5

Step by Step Answer:

Investments Analysis And Management

ISBN: 9781118975589

13th Edition

Authors: Charles P. Jones, Gerald R. Jensen