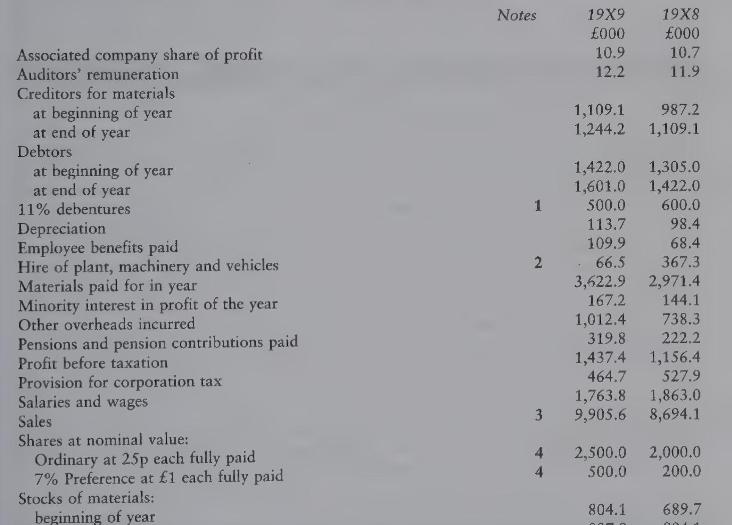

.A The following information relates to the Plus Factors Group plc for the years to 30 September...

Question:

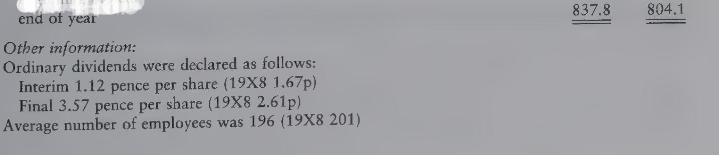

.A The following information relates to the Plus Factors Group plc for the years to 30 September 19X8 and 19X9.

Notes (1 £ 300,000\) of debentures were redeemed at par on 31 March 19X9 and \(£ 200,000\) new debentures at the same rate of interest were issued at 9 per cent on the same date.

The new debentures are due to be redeemed on 31 March 19X4.

2 This is the amount for inclusion in the profit and loss account in accordance with SSAP 21.

3 All the group's sales are subject to value added tax at 15 per cent and the figures given include such tax. All other figures are exclusive of value added tax.

4 All shares have been in issue throughout the year.

Required

(a) Prepare a statement of value added for the year to 30 September 19X9 and give comparative figures for 19X8. Include a percentage breakdown of the distribution of value added for both years.

(b) Produce ratios related to employees' interests, based on the statement in part (a), and explain how they might be of use.

(c) Explain briefly what are the difficulties of measuring and reporting financial information in the form of a statement of value added.

Step by Step Answer: