The balance sheet of Planners Ltd on 31 March 19 X6 was as follows: The dividend on

Question:

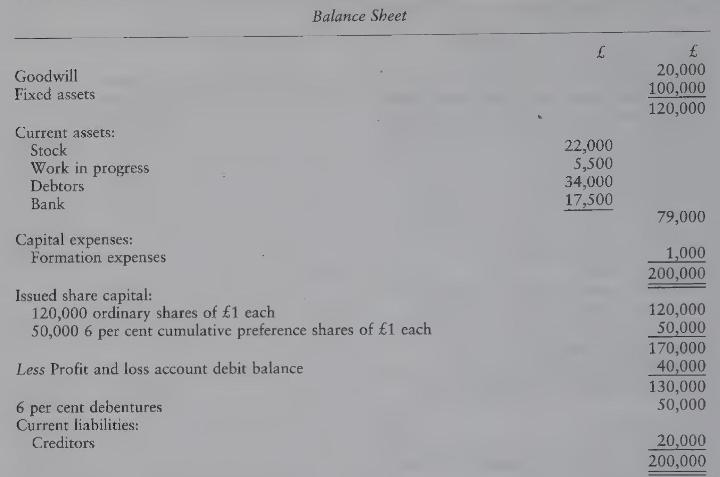

The balance sheet of Planners Ltd on 31 March 19 X6 was as follows:

The dividend on the preference shares is \(£ 9,000\) in arrears. A scheme of reconstruction was accepted by all parties and was completed on 1 April 19X6.

A new company was formed, Budgets Ltd, with an authorised share capital of \(£ 200,000\), consisting of 200,000 ordinary shares of \(£ 1\) each. This company took over all the assets of Planners Ltd. The purchase consideration was satisfied partly in cash and partly by the issue, at par, of shares and debentures by the new company in accordance with the following arrangements:

1 The creditors of the old company received, in settlement of each \(£ 10\) due to them, \(£ 7\) in cash and three fully paid ordinary shares in the new company.

2 The holders of preference shares in the old company received seven fully paid ordinary shares in the new company to everv eight preference shares in the old company and three fully paid ordinary shares in the new company for every \(£ 5\) of arrears of dividend.

3 The ordinary shareholders in the old company received one fully paid share in the new company for every five ordinary shares in the old company.

4 The holders of 6 per cent debentures in the old company received \(£ 40\) cash and \(£ 606\) per cent debentures issued at par for every \(£ 100\) debenture held in the old company.

5 The balance of the authorised capital of the new company was issued at par for cash and was fully paid on 1 April 19 X6.

6 Goodwill was eliminated, the stock was valued at \(£ 20,000\) and the other current assets were brought into the new company's books at the amounts at which they appeared in the old company's balance sheet. The balance of the purchase consideration represented the agreed value of the fixed assets.

\section*{You are required to show:}

(a) The closing entries in the realisation account and the sundry shareholders account in the books of Planners Ltd.

(b) Your calculation of:

(i) the purchase consideration for the assets; and (ii) the agreed value of the fixed assets.

(c) The summarised balance sheet of Budgets Ltd as on 1 April 19X6.

Step by Step Answer: