The accountant of Hook, Line and Sinker, a partnership of seven people, has asked your advice in

Question:

The accountant of Hook, Line and Sinker, a partnership of seven people, has asked your advice in dealing with the following items in the partnership accounts for the year to 31 May 19 X7.

(a) (i) Included in invoices prepared and dated in June \(19 \times 7\) were \(£ 60,000\) of goods despatched during the second half of May \(19 \times 7\).

(ii) Stocks of components at 31 May \(19 \times 7\) include parts no longer used in production. These components originally cost \(£ 50,000\) but have been written-down for purposes of the accounts to \(£ 25,000\). Scrap value of these items is estimated to be \(£ 1,000\). Another user has expressed interest in buying these parts for \(£ 40,000\).

(b) After May 19X7 a customer who accounts for 50 per cent of Hook, Line and Sinker sales suffered a serious fire which has disrupted his organisation. Payments for supplies are becoming slow and Hook, Line and Sinker sales for the current year are likely to be substantially lower than previously. This customer owed \(£ 80,000\) to Hook, Line and Sinker at 31 May 19 X7.

(c) During the year to 31 May Hook, Line and Sinker commenced a new advertising campaign using television and expensive magazine advertising for the first time. Sales during the year were not much higher than previous years as the partners consider that the effects of advertising will be seen in future years.

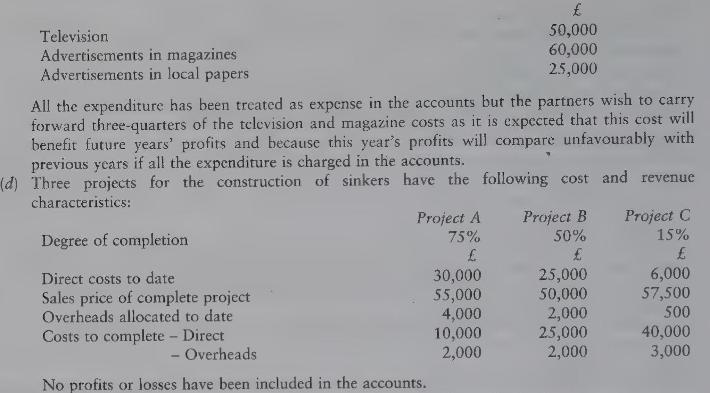

Expenditure on advertising during the year is made up of:

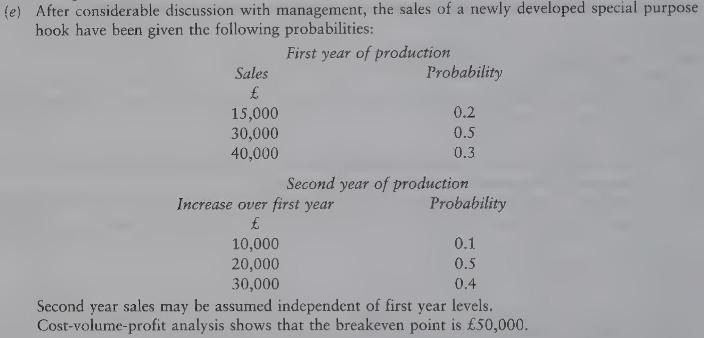

Production of the special purpose hook started prior to the end of the accounting year and stocks of the finished product are included at cost amounting to \(£ 20,000\). It has been decided that if there is less than 0.7 probability of breakeven being reached in the second year then stocks should be written down by 25 per cent.

(f) During the year it was discovered that some stock sheets had been omitted from the calculations at the previous year end. The effect is that opening stock for the current year, shown as \(£ 35,000\), should be \(£ 42,000\). No adjustment has yet been made.

\section*{Required:}

Discuss the treatment of each item with reference to relevant accounting standards and accounting concepts and conventions. Recommend the appropriate treatment for each item showing the profit effect of each recommendation made.

Step by Step Answer: