1. Given the language of the time frame notice, do you agree with the courts statements that...

Question:

1. Given the language of the time frame notice, do you agree with the court’s statements that it was clear and that objectively reasonable consumers would not be confused by it? Why or why not?

2. The court says that any “reasonably alert” person is the average consumer. Do you agree that the average consumer is reasonably alert? What standard should be used to judge the “average consumer”?

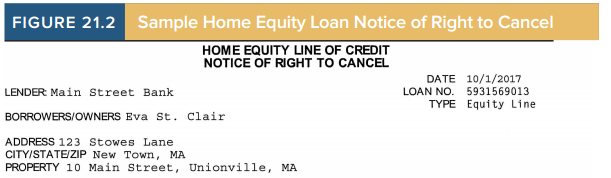

3. Examine Figure 21.2. This is a notice that is similar to the notice Palmer received. Does it affect your analysis?

In March 2003, Palmer obtained a debt-consolidation loan from Champion that was secured by a second mortgage on her home. (This type of loan is also known as a home equity loan.) On the day the loan closing took place, she signed several loan documents as well as the required TILA disclosures. Several days later, Palmer received copies of these documents by mail along with the “notice of her right to cancel” disclo-sure required by the TILA. The notice of her right to cancel provided that Palmer could “cancel the trans-action for any reason within three business days of (1) the date of the transaction, (2) the date she received her TILA disclosures, or (3) the date she received the notice of right to cancel.” The notice also provided that if she was to cancel the transaction by mail or telegraph, the cancellation had to be postmarked no later than April 1, 2003. Palmer did not cancel the transaction within the allotted time period. However, in August 2004 she filed for cancellation of the transaction under the extended three-year statute of limitations under the TILA, claiming that Champion failed to make TILA dis-closures because the time frames in the cancellation notice were too confusing.

The U.S. Court of Appeals for the First Circuit affirmed the trial court’s decision and dismissed Palmer’s claim. The court reasoned that the notice of right to cancel provided by Champion complied with the TILA disclosure requirements and that an objectively reasonable consumer would not find the notice confusing. Therefore, Palmer’s right to rescind was not extended by a failure to follow TILA procedures.

“[I]n the TILA context . . . we, like other courts, have focused the lens of our inquiry on the text of the disclosures themselves rather than on plaintiffs’ descriptions of their subjective understandings. . . . This emphasis on objective reasonableness, rather than subjective understanding, is also appropriate in light of the sound tenet that courts must evaluate the adequacy of TILA disclosures from the vantage point of a hypothetical average consumer—a consumer who is neither particularly sophisticated nor particularly dense. . . . Thus, we turn to the question of whether the average consumer, looking at the Notice objectively, would find it confusing. We conclude that she would not. . . . It clearly and conspicuously indicates that the debtor can rescind ‘within three (3) business days from whichever of [three enumerated] events occurs last.’ . . . We fail to see how any reasonably alert person—that is, the average consumer—reading the Notice would be drawn to the April 1 deadline without also grasping the twice-repeated alternative deadlines. . . . Because we find the Notice clear and adequate, and because the plaintiff otherwise concedes receiving all the required disclosures, her right of rescission under the TILA had long expired by the time she commenced this action.”

Step by Step Answer:

Legal Environment of Business A Managerial Approach Theory to Practice

ISBN: 978-1259686207

3rd edition

Authors: Sean Melvin, Enrique Guerra Pujol