U.S. saving and government deficits This question continues the logic of Problem 9 to explore the implications

Question:

U.S. saving and government deficits This question continues the logic of Problem 9 to explore the implications of the U.S. government budget deficit for the long-run capital stock. The question assumes that the United States will have a budget deficit over the life of this edition of the text.

a. The World Bank reports gross domestic saving rate by country and year. The Web site is http://data.worldbank.org/ indicator/NY.GDS.TOTL.KN. Find the most recent number for the United States. What is the total saving rate in the United States as a percentage of GDP? Using the depreciation rate and the logic from Problem 9, what would be the steady-state capital stock per worker? What would be steady-state output per worker?

b. Go to the most recent Economic Report of the President (ERP) and find the most recent federal deficit as a percentage of GDP. In the 2015 ERP, this is found in Table B-20. Using the reasoning from Problem 9, suppose that the federal budget deficit was eliminated and there was no change in private saving. What would be the effect on the long-run capital stock per worker? What would be the effect on long-run output per worker?

c. Return to the World Bank table of gross domestic saving rates. How does the saving rate in China compare to the saving rate in the United States?

Data from question 9

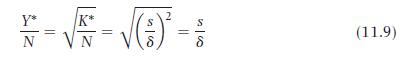

Deficits and the capital stockFor the production function, Y = √K √N equation (11.9)

gives the solution for the steady-state capital stock per worker.

Equation 11.9

Step by Step Answer: