A new restaurant was incorporated on January 1, 2005. Forty thousand shares were issued for $6.00 cash

Question:

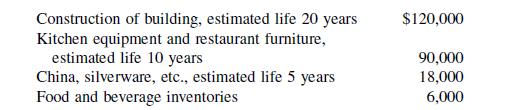

A new restaurant was incorporated on January 1, 2005. Forty thousand shares were issued for $6.00 cash per share. The cash received from the sale of shares was used, in part, as follows:

The remaining cash was deposited in a bank account.

The following estimates were made about the volume of business and operating expenses for the first three months:

a. Sales revenue:![]()

b. Sales revenue will be 55 percent cash and 45 percent credit; maximum credit to be allowed is 30 days.

c. Food cost and liquor cost will average 38 percent of total sales revenue.

Forty percent of this cost each month will be cash; the balance will be paid in the month following purchase.

d. Wages and salaries: the fixed portion of wages will be $5,200 a month; the variable portion will be 30 percent of any sales revenue in excess of $25,000 a month. Total wages and salaries is the sum of the fixed and variable portions. Wages and salaries will be paid in the current month.

e. Other operating costs will be $3,800 a month to be paid in the month following incurrence of the cost.

f. Depreciation for building, equipment and furniture, and china and silverware is to be calculated on a straight-line basis. The annual depreciation amount must be prorated monthly to the income statements.

Note that, because of increasing sales revenue, a further cash investment in food and beverage inventories of $2,000 will have to be made in February, with another increase of $2,000 in March. This will increase total inventory investment to $10,000 by the end of March.

Required 1. A budgeted income statement for the three months ending March 31, 2005.

2. A cash budget for each of the first months of 2005.

3. A balance sheet as of March 31, 2005.

Step by Step Answer:

Hospitality Management Accounting

ISBN: 9780471092223

8th Edition

Authors: Martin G Jagels, Michael M Coltman