Computation of NPV and tax payable Sound Equipment Ltd was formed five years ago to manufacture parts

Question:

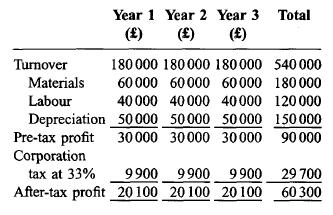

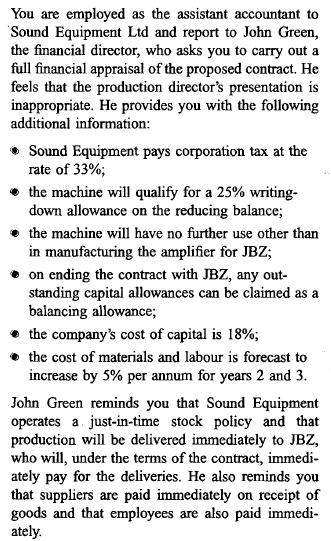

Computation of NPV and tax payable Sound Equipment Ltd was formed five years ago to manufacture parts for hi-fi equipment. Most of its customers were individuals wanting to assemble their own systems. Recently, however, the company has embarked on a policy of expansion and has been approached by JBZ plc, a multinational manufacturer of consumer electronics. JBZ has offered Sound Equipment Ltd a contract to build an amplifier for its latest consumer product. If accepted, the contract will increase Sound Equip- ment's turnover by 20%. JBZ's offer is a fixed price contract over three years, although it is possible for Sound Equipment to apply for subsequent contracts. The contract will involve Sound Equipment purchasing a specialist machine for 150 000. Although the machine has a 10-year life, it would be written off over the three years of the initial contract as it can only be used in the manufacture of the amplifier for JBZ. The production director of Sound Equipment has already prepared a financial appraisal of the proposal. This is reproduced below. With a capital cost of 150000 and total profits of 60300, the production director has calculated the return on capital employed as 40.2%. As this is greater than Sound Equipment's cost of capital of 18%, the production director is recommending that the board accepts the contract.

Write a report to the financial director. Your report should:

(a) use the net present value technique to identify whether or not the initial three-year contract is worthwhile;

(b) explain your approach to taxation in your appraisal;

(c) identify one other factor to be considered before making a final decision.

For the purpose of this task, you may assume the following: the machine would be purchased at the beginning of the accounting year; there is a one-year delay in paying corporation tax; all cashflows other than the purchase of the machine occur at the end of each year; Sound Equipment has no other assets on which to claim capital allowances.

Step by Step Answer: