National Aerospace Group-Measuring Vendor Performance (C. Ittner) National Aerospace Group (NAG) is a leading manufacturer of military

Question:

National Aerospace Group-Measuring Vendor Performance (C. Ittner)

National Aerospace Group (NAG) is a leading manufacturer of military and commercial aircraft and components. With the recent consolidation in the defense industry, National Aerospace faces increasing pressure to reduce costs and improve quality. One of the largest opportunities for cost reduction and quality improvement . is in materials costs, which make up 70% of the firm's cost structure. A recent study revealed that 50% of the more than 100,000 receipts from suppliers during the previous year had paperwork or hardware discrepancies or did not meet delivery schedules. These problems were conservatively estimated to cost National Aerospace $20 million annually.

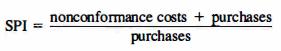

The obvious need for better quality and on-time delivery from suppliers led to the development of the Supplier Performance Rating System. The system measures the added administrative costs that NAG incurs to resolve suppliers' hardware, paperwork, and delivery deficiencies. Each type of nonconformance "event" is assigned a standard cost based on a study of the hours required to resolve the problem. The number of events over the previous year is multiplied by the associated standard cost to obtain the total cost of nonconformance. A supplier performance index (SPI) is then calculated as follows:

The SPI is used to determine the total "cost of ownership" when selecting suppliers.

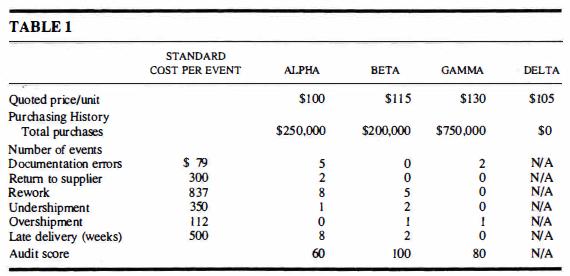

For example, if the quoted price is $ I 00 per unit and the supplier's SPI is 1.2, a value of $120 per unit is used in the supplier selection process. The 20% markup reflects the additional quality-related costs that NAG expects to incur if this supplier is selected. In addition to the SPI system, NAG conducts annual supplier audits to assess their technical and manufacturing capabilities and their assistance in cost reduction and new product development efforts. Audit scores range from a low of O to a high of l 00. NAG's purchasing department has just received four bids for a critical component needed for the finn' s new commercial aircraft. Three of the bids are from existing suppliers;

the fourth is from a highly recommended new supplier. The information in Table l is available on the four suppliers:

Nancy Gilbert, the head of purchasing, has called a meeting with the managers of engineering and manufacturing to review the bids. One issue is the lack of performance history on Delta Products. Discussions with other companies that have used all four suppliers indicate that Delta had the highest quality and best on-time delivery. NAG's purchasing procedures, however, require new suppliers to either be the low bidder or to have the lowest cost of ownership using the average SPI for all the bidders with perfonnance history.

A second issue is Alpha's low audit score. Robert Bilsland, the manager of engineering, is adamant that audit scores should be considered in the decision. "Beta may have bid 15% higher than Alpha, but Beta has given us a lot more assistance in cost reduction efforts and product development. This is reflected in Beta's audit score, which is 40 points better than Alpha's audit score. We should weight audit scores at least 50%

when selecting the supplier."

Given the importance of this component and the large number of units that need to be purchased, the managers realize that the contract should go to the supplier offering the best overall value to NAG, rather than the lowest quoted price.

Required ( I ) Calculate the adjusted bids from Alpha, Beta, and Gamma after taJcing into account the SPI. On the basis of the cost of ownership, which supplier is the lowest cost?

(2) Calculate the adjusted bid from Delta using the average SPI for Alpha, Beta, and Gamma. How does this adjusted bid change the supplier selection decision? Should this method be used for evaluating bids from new suppliers?

(3) Assume that NAG decides to place a 50% weight on audit scores and a 50% weight on the SPI-adjusted bids. Also assume that Delta would receive the average audit score from the other three bidders. Would these conditions change the supplier selection decision?

Should the supplier audit be considered in the selection process?

Step by Step Answer:

Advanced Management Accounting

ISBN: 9780132622882

3rd Edition

Authors: Robert S. Kaplan, Anthony A. Atkinson, Kaplan And Atkinson