Nobic Enterprises has received a special order from an esteemed client. The company needs Machine C to

Question:

Nobic Enterprises has received a special order from an esteemed client. The company needs Machine C to fulfil the order. The company has the option to either purchase the machine or lease it from one of its vendors. The company has decided to evaluate both options using various capital budgeting techniques.

The following additional information is available on both investments:

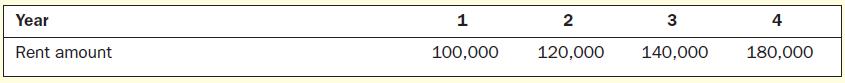

• The initial investment required to purchase Machine C is £400,000. At the end of four years, the machine will have a salvage value of £85,000. The installation costs incurred will be £110,000. On the other hand, if the company leases a similar machine from a vendor, it will incur the following amounts as rent at the end of each year:

• The additional working capital required for both investment alternatives is £120,000. At the end of the four-year period, the working capital would be released for further investment projects.

• The annual cost saving from the purchase of the machine is £20,000 each year.

• A non-refundable deposit of £375,000 must be paid to the vendor if the company leases the machine.

• The annual revenue from leasing the machine is £400,000 each year, and the annual revenue from the purchase of the machine is £350,000 each year.

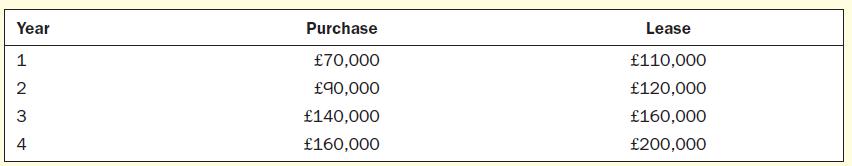

• Cash operating expenses incurred at the end of each year from the use of the machine are as follows:

• The company computes depreciation on a straight-line basis. An annual depreciation of £140,000 is

incurred from the purchase of the machine. The company does not incur any depreciation on lease.

• The company uses a discount rate of 10%.

Required

1. Calculate the net present value from the purchase of the machine.

2. Nobic Enterprises has decided to use a capital budgeting technique that focuses on accounting profit

rather than cash flows. Which capital budgeting techniques focus on accounting profit?

3. Discuss the effect of cash inflows on the NPV of the project.

4. Calculate the NPV from the lease of the machine.

5. Calculate the profitability index arising from the purchase of the machine.

6. Calculate the profitability index arising from the lease of the machine.

7. Nobic Enterprises decides to purchase Machine C and wants to check the feasibility of the purchase by comparing it with Machine D. Under what circumstances should Nobic purchase Machine C?

8. Based on the net present value method, should the company purchase or lease the machine?

Step by Step Answer:

Management Accounting

ISBN: 9780077185534

6th Edition

Authors: Will Seal, Carsten Rohde, Ray Garrison, Eric Noreen