P54 Cost Allocation: Direct Method Time allowed: 30 minutes The Sendai Co. Ltd of Japan has budgeted

Question:

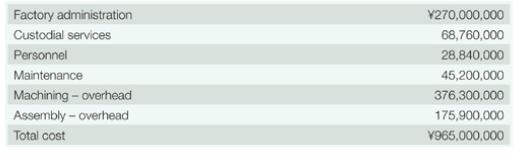

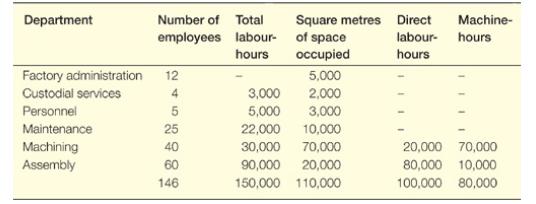

P5–4 Cost Allocation: Direct Method Time allowed: 30 minutes The Sendai Co. Ltd of Japan has budgeted costs in its various departments as follows for the coming year:

The Japanese currency is the yen, denoted by ¥. The company allocates service department costs to other departments in the order listed below.

Machining and Assembly are operating departments; the other departments all act in a service capacity. The company does not make a distinction between fixed and variable service department costs. Factory administration is allocated on the basis of labour-hours; Custodial services on the basis of square metres occupied; Personnel on the basis of number of employees; and Maintenance on the basis of machine-hours.

Required 1 Allocate service department costs to departments using the direct method.

Then compute predetermined overhead rates in the operating departments using a machine-hours basis in Machining and a direct labour-hours basis in Assembly.

2 Assume that the company does not want to bother with allocating service department costs but simply wants to compute a single plantwide overhead rate based on total overhead costs (both service department and operating department) divided by total direct labour-hours. Compute the overhead rate.

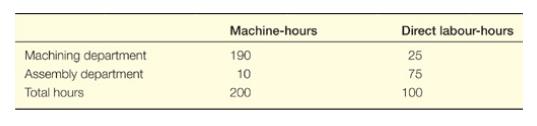

3 Suppose a job requires machine and labour time as follows:

Using the overhead rates computed in (1) and (2), compute the amount of overhead cost that would be assigned to the job if the overhead rates were developed using the direct method and the plantwide method.

Step by Step Answer: