Reliable Automative Manufacturers Ltd. (RAML) is an automatic components/parts supplier. The Hyundai Motors has approached the RAML

Question:

Reliable Automative Manufacturers Ltd. (RAML) is an automatic components/parts supplier.

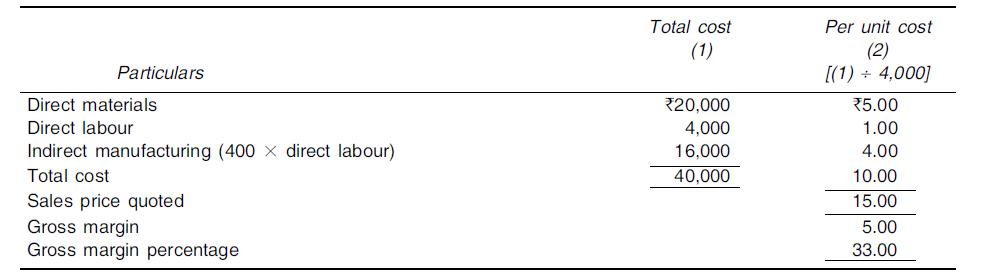

The Hyundai Motors has approached the RAML to expand its production part P-808 to a total annual quantity of 4,000 units. P-808 is a low-volume, complex product with a high gross margin that is based on a proposed/quoted unit sale price of ₹15. The RAML uses the traditional costing system, allocating indirect manufacturing costs currently at 400 per cent of direct labour cost (i.e. ₹1,32,00,000 annual factory overhead 4 ₹33,00,000 annual direct labour cost). Producing 4,000 units of part P-808 requires

₹20,000 of direct materials and ₹4,000 of direct labour. The unit cost and gross margin percentage of P-808 according to the traditional costing system are computed below:

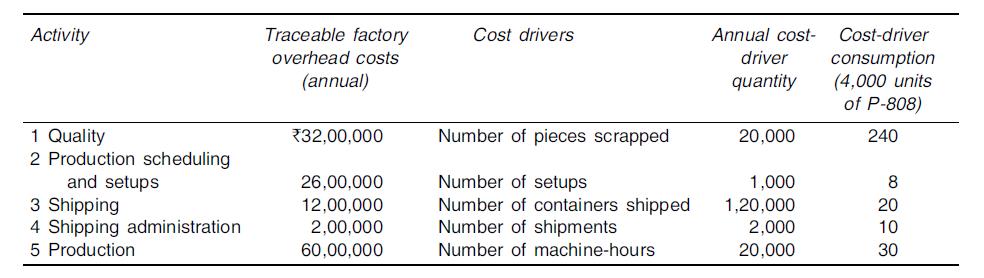

The management of RAML has decided to examine the effectiveness of their traditional costing system versus an activity-based costing system. The following data have been collected by a team of accounting and engineering analysts:

REQUIRED:

(a) Calculate the unit cost and gross margin of part P-808 using the ABC approach.

(b) Based on

(a) which course of action would you recommend regarding the Hyundai’s proposal?

Step by Step Answer:

Management Accounting Text Problems And Cases

ISBN: 9781259026683

6th Edition

Authors: M Y Khan, P K Jain