The Angler-Cost Company recently established two new plants for the manufacture of toy go-carts (plant X) and

Question:

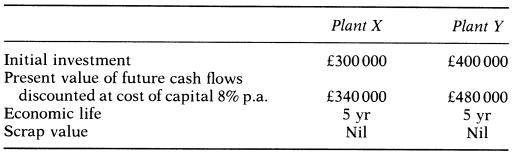

The Angler-Cost Company recently established two new plants for the manufacture of toy go-carts (plant X) and skate-boards (plant Y). The investment decisions were made on the following basis:

Expected cash flows were f50000 in year 1 and f 1 00000 in year 2; both plants achieved expectations in year 1. In year 2, plant X earned a cash flow of f80000. A competitor's innovation of replacing the conventional wheels of toy go-carts with low friction skate-board wheels resulted in a fall in demand. The plant manager estimated that f25000 cash flow had been lost as a result. In year 2, plant Y earned a cash flow of f105000.

Of this EiO 000 related to the sale of skate-board wheels to an external third party, the innovative competitor of X, which had not been included in the original investment decision.

Assuming that cash flows approximate to controllable profit, calculate the residual income in year 2 for each plant (adopting straight line depreciation).

Discuss the appraisal of performance and the assumptions of the original expectations.

Briefly outline what action, if any, should be taken in respect of the individual plant manager's performance.

Step by Step Answer: