The Matterhorn Instruments Co. in Geneva, Switzerland, has the following 2012 budget for its two departments in

Question:

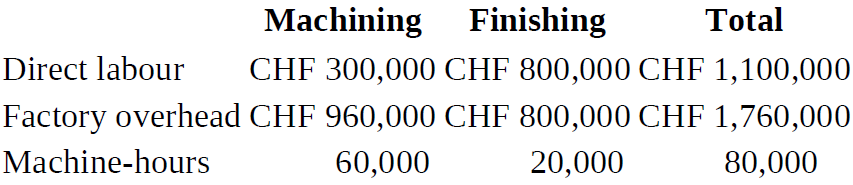

The Matterhorn Instruments Co. in Geneva, Switzerland, has the following 2012 budget for its two departments in Swiss francs (CHF):

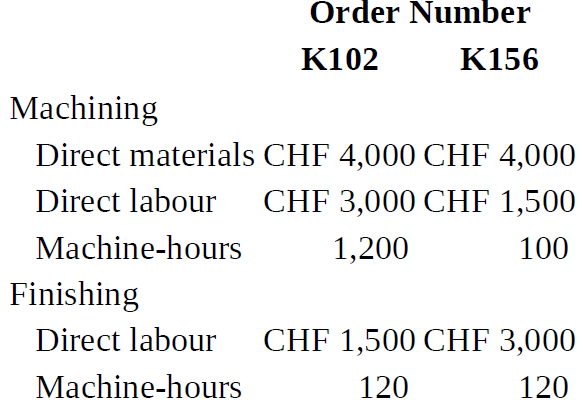

In the past, the company has used a single plantwide overhead application rate based on direct labour cost. However, as its product line has expanded and as competition has intensified, Hans Volkert, the company president, has questioned the accuracy of the profits or losses shown on various products. Volkert makes custom tools on special orders from customers. To be competitive and still make a reasonable profit, it is essential that the firm measure the cost of each customer order. Volkert has focused on overhead allocation as a potential problem. He knows that changes in costs are more heavily affected by machine-hours in the first department and by direct labour costs in the second department. As company controller, you have gathered the following data regarding two typical customer orders:

1. Compute six factory overhead application rates, three based on direct labour cost and three based on machine-hours for machining, finishing, and for the plant as a whole.

2. Use the application rates to compute the total costs of orders K102 and K156 as follows: (a) plantwide rate based on direct labour cost and (b) machining based on machine-hours and finishing based on direct labour cost.

3. Evaluate your answers in requirement 2. Which set of job costs do you prefer? Why?

Step by Step Answer:

Management Accounting

ISBN: 978-0132570848

6th Canadian edition

Authors: Charles T. Horngren, Gary L. Sundem, William O. Stratton, Phillip Beaulieu