Yoha Petroleum Ltd has evaluated an investment proposal to manufacture a petroleum product. After evaluation, the company

Question:

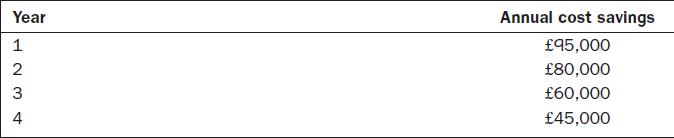

Yoha Petroleum Ltd has evaluated an investment proposal to manufacture a petroleum product. After evaluation, the company has decided to buy equipment to help manufacture this product. The initial investment in the equipment is £200,000. The company has estimated that the salvage value will be zero at the end of four years. The annual cost savings from the use of the equipment are given below:

The company expects a 2 per cent inflation in the cash flows associated with the new equipment. Yoha Petroleum uses a real cost of capital of 10 per cent per year.

Required

1. Calculate the net present value of the equipment.

(a) Assume inflation is ignored.

(b) Assume inflation is considered.

2. Does the inflation have an impact on a capital budgeting analysis? Support your answer using the net present value calculated for Yoha Petroleum Ltd in Requirement 1.

Step by Step Answer:

Management Accounting

ISBN: 9780077185534

6th Edition

Authors: Will Seal, Carsten Rohde, Ray Garrison, Eric Noreen