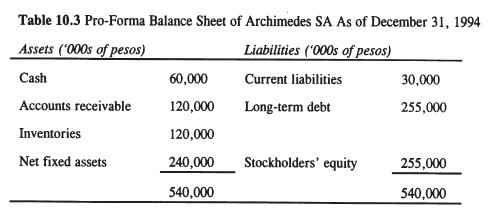

On December 31, 1994, Archimedes SA, the Mexican afflliate of a U.S. manufacturing company, has the Peso

Question:

On December 31, 1994, Archimedes SA, the Mexican afflliate of a U.S.

manufacturing company, has the Peso (Ps)-denominated balance sheet shown in table 10.3. The current exchange rate is Ps5 = $1.

(a) One-year peso forward contracts are available in the United States at a 20% discount. Show how the peso translation exposure can be hedged, assuming that exchange losses are tax-deductible at 34% from normal corporate income tax.

(b) Explain how refmancing the long-term debt in dollars at 12.5 % in lieu of the prevailing 35% interest rate on Peso-denominated long-term debt would result in an alternative translation hedge. How does it compare with the contractual hedge introduced in part (a)?

Step by Step Answer:

Management And Control Of Foreign Exchange Risk

ISBN: 978-0792380887

1st Edition

Authors: Laurent L. Jacque