Over the years, a number of developing countries have maintained an advance deposit scheme for imports. Such

Question:

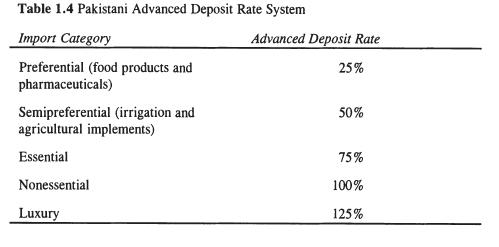

Over the years, a number of developing countries have maintained an advance deposit scheme for imports. Such systems typically require importers to deposit with the central bank a percentage of the face value, in local currency, of the contemplated import transaction, even though the foreign exchange has not been released nor the import delivered. Characteristically, the percentage of the face value of the import will be linked to some import classification list established at the discretion of the central bank and should reflect the relative degree of essentialness of the product to be imported.

Consider the case of Pakistan, whose currency is pegged to the U. S. dollar.

The Pakistan central bank defines an import classification list, to which it associates an advance deposit rate. (See table 1.4.)

Assuming that the opportunity cost of funds for a Pakistani importer is 15 %

and that the average length of an advance deposit is 270 days, explain why our Pakistani importer is de facto transacting through a multiple exchange rate systems, and compute the effective multiple exchange rates.

Step by Step Answer:

Management And Control Of Foreign Exchange Risk

ISBN: 978-0792380887

1st Edition

Authors: Laurent L. Jacque