Advanced: Calculation of cost per unit, break-even point and a recommended selling price A chemical company produces

Question:

Advanced: Calculation of cost per unit, break-even point and a recommended selling price A chemical company produces amongst its product range two industrial cleaning fluids, A and B. These products are manufactured jointly. In 2001 total sales are expected to be restricted because home trade outlets for fluid B are limited to 54 000 gallons for the year. At this level plant capacity will be under-utilized by 25%.

From the information given below you are required to:

(a) draw a flow diagram of the operations;

(b) calculate separately for fluids A and B for the year:

(i) total manufacturing cost;

(ii) manufacturing cost per gallon;

(iii) list price per gallon;

(iv) profit for the year;

(c) calculate the break-even price per gallon to manufacture an extra 3000 gallons of fluid B for export and which would incur selling, distribution and administration costs of £1260;

(d) state the price you would recommend the company should quote per gallon for this export business, with a brief explanation for your decision.

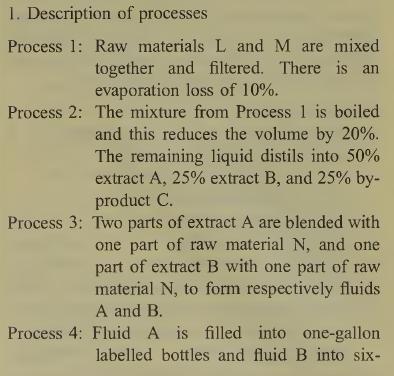

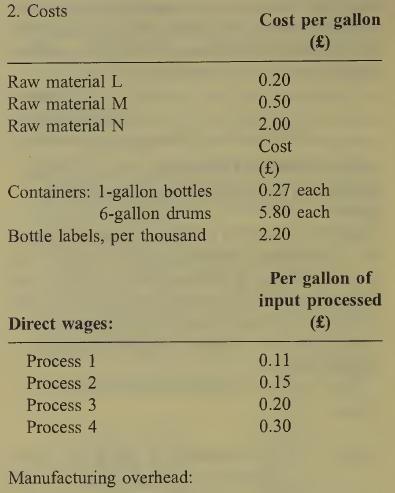

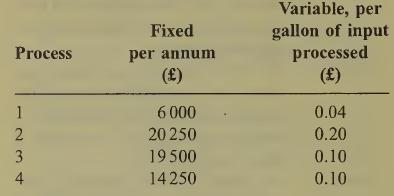

The following data are given:

gallon preprinted drums and they are then both ready for sale. One percent wastage in labels occurs in this process.

By-product C is collected in bulk by a local company which pays £0.50 per gallon for it and the income is credited to process 2.

Process costs are apportioned entirely to the two main products on the basis of their output from each process.

No inventories of part-finished materials are held at any time.

Fluid A is sold through agents on the basis of list price less 20% and fluid B at list price less 33-%.

Of the net selling price, profit amounts to 8%, selling and distribution costs to 12% and adminis¬ tration costs to 5%.

Taxation should be ignored.

Step by Step Answer: