Advanced: Calculation of NPV from incomplete data involving taxation, financing costs and identification of relevant cash flows

Question:

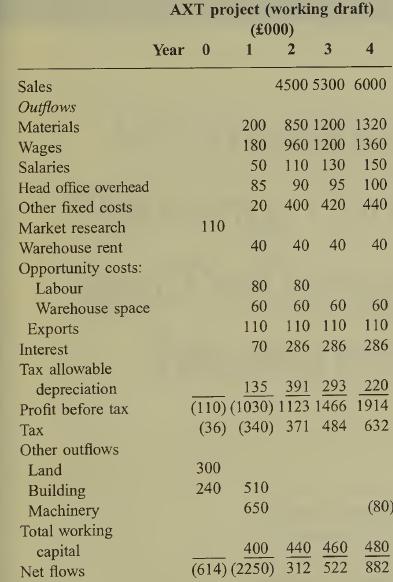

Advanced: Calculation of NPV from incomplete data involving taxation, financing costs and identification of relevant cash flows and cost of capital An unqualified colleague has recently been moved to another office whilst part way through a job. His working notes on a capital investment project have been given to you.

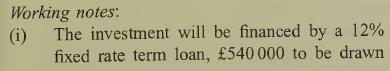

down immediately, £1 560000 to be drawn down at the end of year one.

(ii) Working capital of £480000 is expected to be returned in full in year five.

(iii) Highly skilled labour would need to be taken from other jobs losing £80 000 per year post¬ tax contributions for two years. These work¬ ers could not be replaced in the other jobs.

(iv) The warehouse space could be rented to another company for £60000 per year if not used for this investment.

(v) The project will result in a reduction in exist¬ ing exports ofanother product, causing pre-tax contributions to fall by £110 000 per year.

(vi) One manager, at an initial year one salary of £25 000 per year (increasing by 5% per year) will be transferred from another division. If he had not been transferred he would have been made redundant at an immediate after tax cost to the company of £40000. This manager is additional to the salaries shown in the working draft.

(vii) Data includes the estimated effects of infla¬ tion on costs and prices wherever relevant.

(viii) Head office cash flows for overhead will increase by £40 000 as a result of the project in year one, rising by £5000 per year after year one.

(ix) Tax is at a rate of 33% per year payable one year in arrears. The company has other profitable projects.

(x) Tax allowable depreciation is 2.5% per year straight line on buildings and 25% per year reducing balance on machinery.

(xi) Land and buildings are expected to increase in value by 5% per year.

(xii) The company’s cost of capital is 16%.

(xiii) Company equity beta is 1.3 Company asset beta is 1.1 Average equity beta of companies in the same industry as the new AXT project is 1.5 Average asset beta of companies in the same industry as the new AXT project is 1.2 The market return is 15% per year and the risk free rate 6% per year.

(xiv) Company gearing:

Book value 60% equity, 40% debt Market value 76% equity, 24% debt.

(xv) The market research survey was undertaken last month.

(xvi) The company has a time horizon of three years of sales for evaluating this investment.

Required:

(a) Using the working draft and any other relevant information, complete the appraisal of the AXT project.

There are no arithmetic errors in the work¬ ing draft, but there might be errors of prin¬ ciple that result in incorrect data.

State clearly any assumptions that you make. (20 marks)

(b) Discuss possible limitatiops pf net present value as the decision criterion for a capital investment. (5 marks)

(Tptal 25 marks)

ACCA Level 3 financial Management

Step by Step Answer: