Advanced: Expected value comparison of low and high price alternatives The research and development department of Shale

Question:

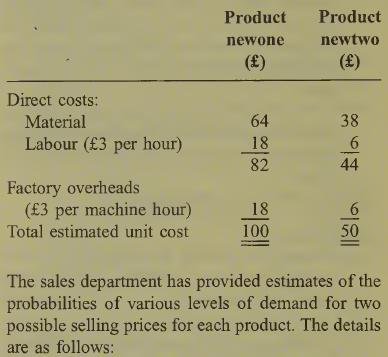

Advanced: Expected value comparison of low and high price alternatives The research and development department of Shale White has produced specifications for two new products for consideration by the company’s production director. The director has received detailed costings which can be summarized as follows:

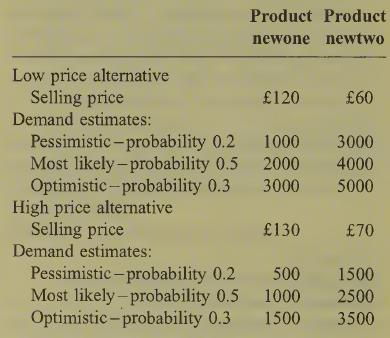

It would be possible to adopt the low price alter-

native for product newone together with the high price alternative for newtwo, or the high price alternative for product newone with the low price alternative for newtwo (demand estimates are inde¬ pendent for the two products).

The factory has 60 000 machine hours available during the year. For some years past it has been working at 90% of practical capacity making a standardized product. This product is very profit- able and it is only the availability of 6000 hours of spare machine capacity that has made it necessary to search for additional product lines to use the machines fully. The actual level of demand will be known at the time of production.

A statistical study of the behaviour of the factory overhead over the past year has indicated that it can be regarded as a linear function of factory machine time worked. The monthly fixed cost is estimated at £10 000 and the variable cost at £1 per machine hour with a coefficient of correla¬ tion of 0.8.

You are required:

(a) to identify the best plan for the utilization of the 6000 machine hours, to comment on the rational selling price alternatives that exist for this plan and to calculate the expected increase in annual profit which would arise for each alternative, (17 marks)

(b) to discuss the relevance of regression analysis for problems of this type. (5 marks)

(Total 22 marks) ACCA Level 2 Management Accounting

Step by Step Answer: