Advanced: Recommendation of which market segment to enter and selling price to charge AB Ltd is a

Question:

Advanced: Recommendation of which market segment to enter and selling price to charge AB Ltd is a well-established company producing high quality, technically advanced, electronic equipment.

In an endeavour to diversify, it has identified opportunities in the hi-fi industry. After some preliminary market research it has decided to market a new product that incorporates some of the most advanced techniques available together with a very distinctive design.

AB Ltd’s special skill is that it can apply these techniques economically to medium-sized quanti¬ ties and offer a product of excellent design with an advanced degree of technology.

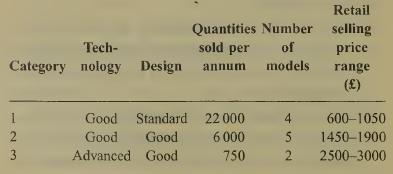

The new product faces three categories of competition:

The product will be distributed through a range of specialist retailers who have undertaken not to discount prices. Their commission will be 25% on retail selling price. AB Ltd has also acquired the rights to sell the product under the name of a prestigious hi-fi manufacturer who does not offer this type of product. For this it will pay a royalty of 5% of the retail selling price.

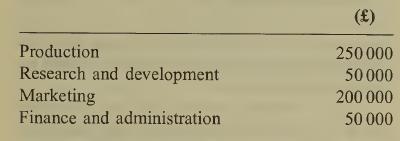

AB Ltd assesses that its direct cost per pro¬ duct will be £670 (excluding the royalty and the retailers’ commission) and the annual fixed costs relevant to the project are budgeted at:

You are required, from the data provided and making such assumptions as you consider reason¬ able,

(a) to suggest a range of retail prices (i.e. to the consumer) from which AB Ltd should choose the eventual price for its product. Explain briefly why you have suggested that range of prices; (10 marks)

(b) to select one particular price from the range in

(a) above that you would recommend AB Ltd to choose. Explain, with any relevant calcula¬ tions, why you have recommended that price. Mention any assumptions that you have made.

(15 marks)

Note: The prices suggested should be rounded to the nearest £100.

Ignore VAT (or sales taxes), taxation and inflation.LO1

Step by Step Answer: