Advanced: Traditional and activity- based budget statements and life-cycle costing The budget for the Production, Planning and

Question:

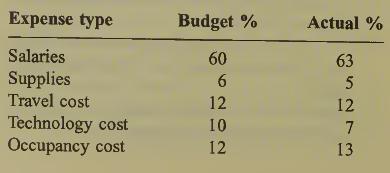

Advanced: Traditional and activity- based budget statements and life-cycle costing The budget for the Production, Planning and Development Department of Obba pic, is currently prepared as part of a traditional budgetary planning and control system. The analysis of costs by expense type for the period ended 30 November 2000 where this system is, in use is as follows:

The total budget and actual costs for the depart¬ ment for the period ended 30 November 2000 are £1 000000 and £1 060000 respectively.

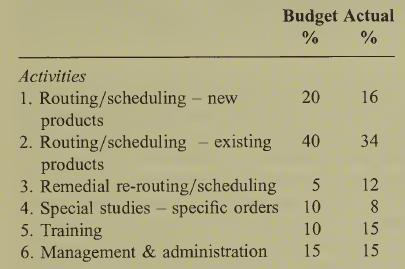

The company now feels that an Activity Based Budgeting approach should be used. A number of activities have been identified for the Production, Planning and Development Department. An inves¬ tigation has indicated that total budget and actual costs should be attributed to the activities on the following basis:

Required:

(a) (i) Prepare two budget control statements for the Production Planning and Development Department for the period ended 30 November 2000 which compare budget with actual cost and show variances using 1. a traditional expense based analysis and 2. an activity based analysis. (6 marks)

(ii) Identify and comment on four advan¬

tages claimed for the use of Activity Based Budgeting over traditional budgeting using the Production Planning and Development example to illustrate your answer. (12 marks)

(iii) Comment on the use of the information provided in the activity based statement which you prepared in (i) in activity based performance measurement and suggest additional information which would assist in such performance measurement. (8 marks)

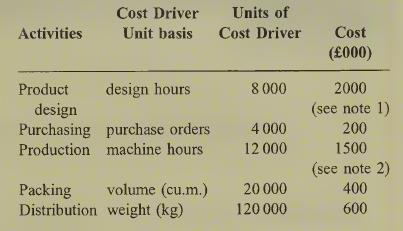

(b) Other activities have been identified and the budget quantified for the three months ended 31 March 2001 as follows:

Note 1\ this includes all design costs for new products released this period.

Note 2: this includes a depreciation provision of £300 000 of which £8000 applies to 3 months depreciation on a straight line basis for a new product (NPD). The remainder applies to other products.

New product NPD is included in the above budget. The following additional information applies to NPD:

(i) Estimated total output over the product life cycle: 5000 units (4 years life cycle).

(ii) Product design requirement: 400 design hours (iii) Output in quarter ended 31 March 2001: 250 units (iv) Equivalent batch size per purchase order: 50 units (v) Other product unit data: production time 0.75 machine hours: volume 0.4 cu. metres; weight 3 kg.

Required:

Prepare a unit overhead cost for product NPD using an activity based approach which includes an appropriate share of life cycle costs using the information provided in

(b) above.

Step by Step Answer: