Division A, which is part ofthe ACF Group, manufactures only one type of product, a Bit, which

Question:

Division A, which is part ofthe ACF Group, manufactures only one type of product, a Bit, which it sells to external customers and also to division C, another member ofthe group. ACF Group's policy is that divisions have the freedom to set transfer prices and choose their suppliers.

The ACF Group uses residual income (RI) to assess divisional performance and each year it sets each division a target RI. The group's cost of capital is 12% a year.

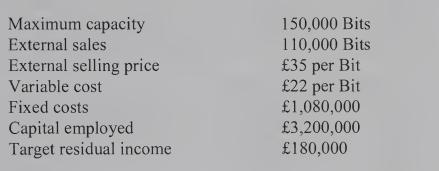

Division A Budgeted information for the coming year is:

Division C Division C has found two other companies willing to supply Bits:

X could supply at £28 per Bit, but only for annual orders in excess of 50,000 Bits.

Z could supply at £33 per Bit for any quantity ordered.

Required:

[Note: Ignore tax for parts

(a) and (b).]

(a) Division C provisionally requests a quotation for 60,000 Bits from division A for the coming year.

(i) Calculate the transfer price per Bit that division A should quote in order to meet its residual income target. (6 marks)

(ii) Calculate the two prices division A would have to quote to division C, ifit became group policy to quote transfer prices based on opportunity costs. (2 marks)

(b) Evaluate and discuss the impact ofthe group's current and proposed policies on the profits of divisions A and C, and on group profit. Illustrate your answer with calculations. (11 marks)

(c) Assume that divisions A and C are based in different countries and consequently pay taxes at different rates: division A at 55% and division C at 25%. Division A has now quoted a transfer price of £30 per Bit for 60,000 Bits.

Calculate whether it is better for the group if division C purchases 60,000 Bits from division A or from supplier X.

25=A & B manufactures cleansing products, which are sold either to retail stores for onward sale to the general public, or in bulk to cleansing companies in the food and hospital sectors.

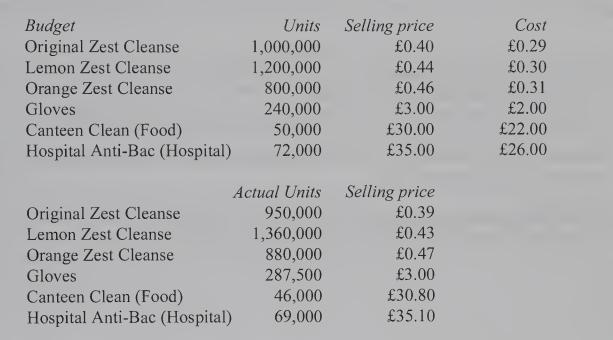

The budgeted and actual information for the month just ended is:

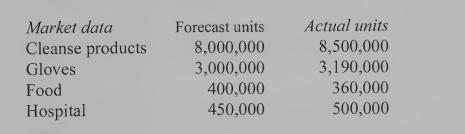

When the company set the budget, the budgeted quantities were based on a forecast ofthe total market for each business sector, which was commissioned from a team ofmarket consultants. This forecast proved to be inaccurate, as is shown in the table below.

Information on retailproducts Orange Zest Cleanse is a recent introduction and is a variation on, and an addition to, the company’s range of Zest Cleanse retail products. Management is pleased with its sales so far. Savamart, the chiefsupermarket group, has recently repositioned the Zest Cleanse products on its shelves so that Lemon and Orange Zest are now at eye level and are situated above the Original Zest Cleanse.

A & B has entered into an agreement with another company to purchase a large number of household protective gloves. A & B is currently running a promotion based on these gloves. They are offered to retail customers who collect and send in tokens from the range ofZest Cleanse products together with a cheque for £3.

Information on bulk cleansing products Over recent years, the market for Canteen Clean has decreased as factory canteens have reduced in number. This product is not suitable for small restaurants, which tend to use retail products or speciality stainless steel cleaners.

The market for Hospital Anti-Bac has grown steadily over the years. The introduction of private hospitals has caused the market to expand and as a result more companies have entered the market for cleansing products.

Required:

(a) Calculate the following variances in appropriate detail:

• sales margin price variances;

• appropriate sales margin mix variances;

• market size and market share variances for the different business sectors.

Summarise your calculations in a profit reconciliation statement. Assume that actual costs for each unit were the same as budget. (18 marks)

(b) Discuss the position revealed in each market sector and suggest areas where further investigation is needed.

Step by Step Answer:

Management And Cost Accounting

ISBN: 9780273687511

3rd Edition

Authors: Charles T. Horngren, George Foster, Srikant M. Datar